CRE risk management: Navigating hazards and opportunities

Abrigo

DECEMBER 18, 2023

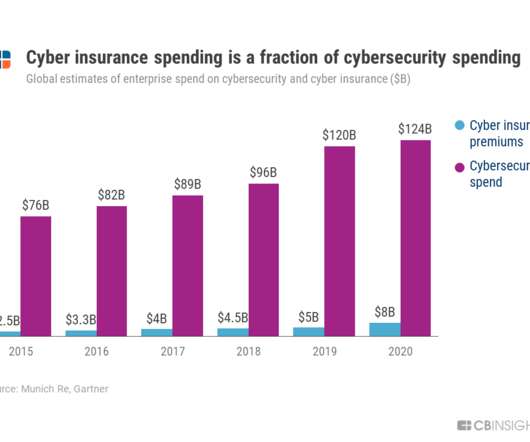

Banks and thrifts hold half of all outstanding CRE debt through the second quarter, with insurance companies accounting for 12% and commercial mortgage-backed securities holding 14%, according to Trepp. But understanding trends in their own portfolios and local markets can allow lenders to identify risk-appropriate CRE credits.

Let's personalize your content