Recovery Has Passed Us By – We Need Hospitals to Be Resilient

Perficient

JULY 10, 2020

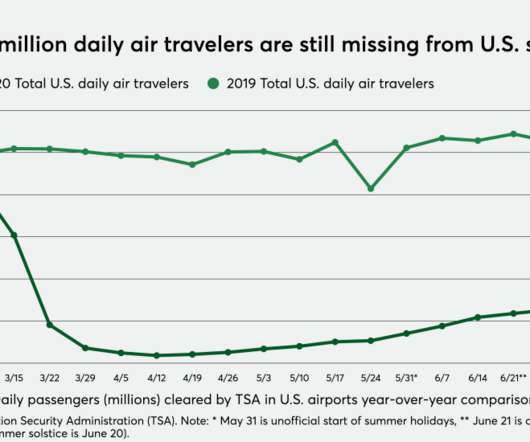

It’s a sad truth that on July 9, 2020, COVID cases are on the rise in America. This series explores six key commitments leaders must make to ensure their organizations survive in a new, uncertain reality. Achieving these commitments will require clinical, marketing, and operations teams partnering more closely together and in a way they never have before.

Let's personalize your content