Deep Dive: How FinTechs, FIs Can Arm Up Against Fraud

PYMNTS

SEPTEMBER 12, 2019

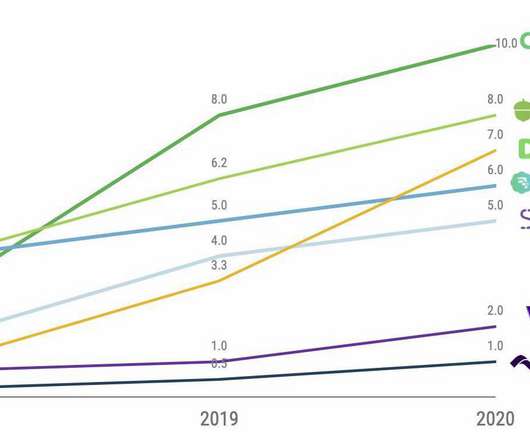

FinTechs could face these same financial pains as regulators increasingly demand that they follow the compliance rules to which FIs must adhere. The People’s Bank of China announced in March that it plans to create rules for regulating and securing the FinTech sector, for example. . A report found that the U.S.

Let's personalize your content