Why Augmented Reality is Crucial to Improving the Ecommerce Customer Experience

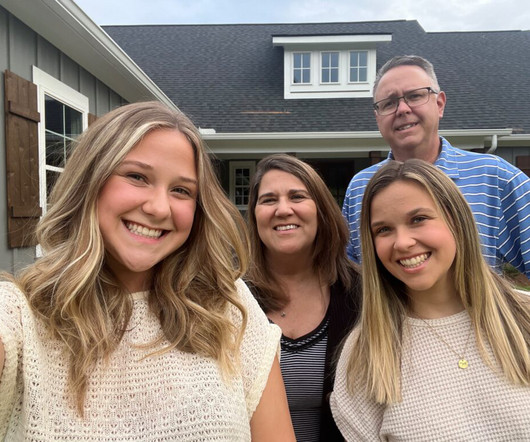

Perficient

JANUARY 12, 2021

We’ve typically seen that this lends itself to focus on areas such as ratings, reviews, and online price shopping, but trends are now showing there are other effective methods for online, as shoppers want to engage with products both at an experiential level and to ensure the best fit for their needs. Giving the Consumer Control.

Let's personalize your content