Digital lending gold rush to continue through 2023, research suggests

Bank Innovation

DECEMBER 30, 2019

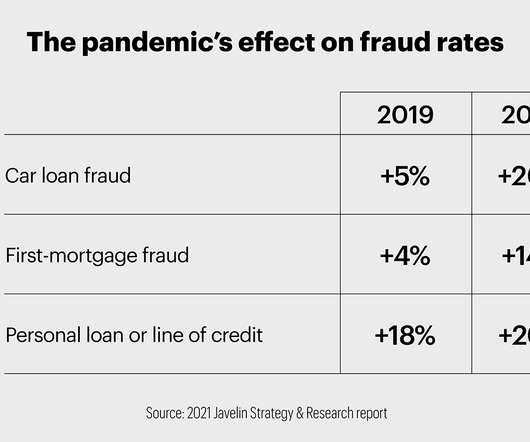

Digital lenders will continue to pursue product diversification strategies as companies expand market share in the coming years, research from S&P Global Market Intelligence concluded. Digital lenders are keen to innovate their product offerings to cater more specifically to different customer segments,” S&P noted in its 2019 U.S.

Let's personalize your content