A Look at DevOps in 2020: Sonatype’s Community Survey

Perficient

JUNE 26, 2020

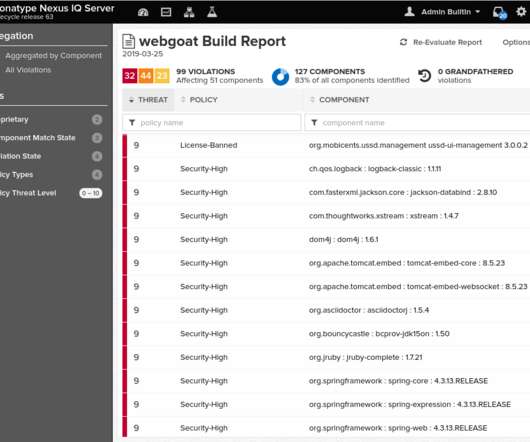

DevOps teams routinely deal with the most sensitive needs of an organization: security, governance, and compliance. Governance and Compliance: Forty-four percent of mature DevOps practices have integrated automated OSS governance into their software development lifecycles (SDLC), reducing the need for manual intervention. 29 and Feb.

Let's personalize your content