Citi Ventures Leads $28 Million Round for Client Management Startup HoneyBook

Bank Innovation

MARCH 21, 2019

Citi Ventures led a $28 million Series C equity round for client management platform HoneyBook, the company announced today.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Bank Innovation

MARCH 21, 2019

Citi Ventures led a $28 million Series C equity round for client management platform HoneyBook, the company announced today.

Bank Innovation

MARCH 9, 2018

EXCLUSIVE - On March 6 in San Francisco, 12 impressive startups demoed their latest in fintech technology at INV Fitnech's 2nd annual demo day. INV Fintech, the sister accelerator to Bank Innovation, is partnered with Fiserv and eight banking partners with over $3 trillion dollars in assets.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Bank Innovation

AUGUST 2, 2019

Nyca Partners has closed on $210 million for its third investment fund, a vehicle that will let it continue to support the growth of fintech innovation, David Sica, partner at the New York- and San Francisco-based venture firm, told Bank Innovation. “There’s really good entrepreneurs […].

PYMNTS

MARCH 31, 2020

San Francisco-based Princeville Capital has announced a $50 million investment in Russian online retailer Ozon, which is partly owned by the Russian-based conglomerate Sistema. Ozon said Emmanuel DeSousa, managing partner at Princeville Capital, joined its board following the transaction.

CB Insights

JANUARY 14, 2020

In case you missed it, the 5th annual Future of Fintech (June 14-16) is moving west to San Francisco. assets under management). Kevin Durant, Sequoia Capital, and Goldman Sachs). CEO, Metromile (pay-per-mile auto insurance backed by NEA, Index Ventures, and First Round Capital). And that’s not the only change.

CB Insights

NOVEMBER 19, 2020

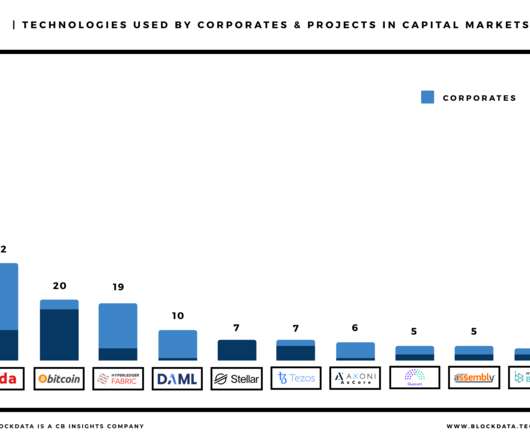

As blockchain tech gains commercial traction, a growing number of companies want to use it to reimagine the capital markets infrastructure that powers the trade of stocks, bonds, and other securities. The chart above shows the core blockchain tech being used by projects and corporates working on DLT applications for capital markets.

Bank Innovation

SEPTEMBER 4, 2019

Credit Sesame, the San Francisco-based credit score monitoring and advice platform, is building out its AI-based credit management tools with the help of a major fundraising round last week.

Bank Innovation

JUNE 28, 2018

Bento for Business wants to provide its customers with money management tools combined with banking solutions, similar to the personal financial management app for millennials, MoneyLion, according to company CEO Farhan Ahmad. For the task, San Francisco-based Bento raised $9 million in a new round of funding today.

PYMNTS

JULY 22, 2020

Brex , the San Francisco financial technology startup, is offering FDIC insurance on its no-fee cash management account, the company announced Wednesday (July 22). This partnership aligns with UMB’s strategy of working with best-in-class innovators like Brex.”.

Bank Innovation

MARCH 7, 2018

EXCLUSIVE (SAN FRANCISCO) -- Welcome back to the fintech boom. At this time last year, fintech was in a downturn. Fintech venture funding was down more than 9% year-over-year; valuations seemed stuck. But the fintech market has rebounded.

PYMNTS

JANUARY 24, 2020

While businesses have more sources of capital than ever before, from bank loans to initial coin offerings to alternative online investments, experts are urging small to medium-sized businesses (SMBs) to take a strategic approach to their fundraising efforts — often by combining a variety of funding sources to mitigate risk.

PYMNTS

OCTOBER 9, 2020

Despite wide-ranging economic uncertainties and a challenging investment environment, venture capital (VC) firms and special purpose acquisition companies (SPACs) are actively raising or seeking fresh funds for investment in the payments space. Kibo added, “We love global companies with very capital efficient structures.”.

PYMNTS

JUNE 10, 2019

The company has reportedly been hiring numerous product managers and engineers. Uber is taking advantage of New York’s talent pool in the financial department, which has more depth in the San Francisco sector. Uber is expanding its services and moving toward providing financial products, according to a report by CNBC.

PYMNTS

OCTOBER 23, 2020

This week's B2B Venture Capital roundup saw more than $76 million in new funding. The startup, which raised the funding from angel investors including Southern Water Managing Director Rob Barnett, EV Cargo CEO Craig Sears-Black and Lyre's Spirit Co. CEO Carl Hartmann, was founded amid the pandemic as supply chain risks skyrocketed.

PYMNTS

NOVEMBER 24, 2020

Indian digital payments platform Cashfree has just landed tens of millions in new capital to help fuel its expansion, the Bengaluru-based company announced on Tuesday (Nov. Cashfree is a “2017 alumnus of Y Combinator,” the San Francisco-based startup incubator, according to the release.

PYMNTS

JULY 31, 2020

the San Francisco-based online bank, had the last laugh. Varo Bank’s opening … represents the evolution of banking and a new generation of banks that are born from innovation and built on technology intended to empower consumers and businesses,” said Brian Brooks, OCC’s acting comptroller in a statement. “As Varo Bank N.A.

PYMNTS

SEPTEMBER 27, 2019

To bolster its subscription business, San-Francisco-based Recurly has notched $19.5 million in funding led by F-Prime Capital along with participation from Polaris Partners, Silicon Valley Bank and Greycroft. The new funding brings its total raise to almost $40 million after raises in the past totaling $19.6

PYMNTS

SEPTEMBER 28, 2020

“We emerge from Chapter 11 as a stronger, more innovative retailer, brand partner and employer.”.

PYMNTS

NOVEMBER 5, 2019

There are a number of transactions that are cross-companies and multi-party that are inefficient, they go through intermediaries, they are very slow,” senior manager at Coke One North America Andrei Semenov said. The funding round was led by Polychain Capital. And we felt that we could improve this and save some money.”.

PYMNTS

APRIL 28, 2017

venture capital sphere this week: VC funding for FinTech startups in Q1 alone hit $1.2 Analysts said the industry has seen its highest venture capital activity since Q1 of 2016, fueled by focus on late-stage investment rounds. This week’s B2B venture capital roundup is quite indicative of these trends. According to KPMG’s U.S.

PYMNTS

MARCH 1, 2019

Cybersecurity returned to the top of the B2B startup investment list as three companies in the enterprise security realm landed nearly half of the $246 million in B2B venture capital this week. Commerce Ventures, Flint Capital, Two Sigma Ventures, Synchrony and Sorenson Capital also participated, according to reports.

PYMNTS

OCTOBER 31, 2019

Launched in 2013, San Francisco-based Particle aims to be an all-in-one solution to help customers bring IoT devices to market by providing encryption and security, as well as data autonomy and scalability. Our customers who started as early innovators are now leaders in their industries.”

PYMNTS

JANUARY 8, 2020

The data compiled into the beginning of the fourth quarter, and as reported by London & Partners and Innovate Finance, showed that more than $ 2 billion had been invested across 114 deals for firms based in that city. That was outpaced, perhaps not surprisingly, by San Francisco, but led New York.

PYMNTS

JULY 13, 2018

This week’s B2B venture capital rundown includes some of the usual suspects, like blockchain and HR tech, and a few not-so-usual ones, like fleet and small business insurance. While it was a quiet week for the industry, B2B startups still managed to secure more than $190 million in funding, mostly situated in the U.S. Greenhouse.

PYMNTS

AUGUST 28, 2017

still manage their bookings with pen and paper,” Shedul co-founder and CEO William Zeqiri said in an interview. The round was led by Middle East Venture Partners (MEVP), and backed by Dubai’s BECO Capital and San Francisco-based Lumia Capital. A full 52 percent of salons in the U.S.

PYMNTS

MARCH 30, 2018

Boston-based PreVeil did not disclose how much it raised in its Series A funding round, but it did note that Spark Capital provided the funding to support the company’s email and file security solution. Kenna said it plans to use the funds to expand its team, focus on sales and continue innovation efforts. Cybersecurity. Back-Office.

CB Insights

MARCH 20, 2019

China Development Bank Capital, Coatue Management, Hillhouse Capital Management, IDG Capital, Temasek Holdings, Tencent Holdings, Tiger Global Management. Select Investors : Credit Suisse, Deutsche Bank, DST Global, GGV Capital, Goldman Sachs, IDG Capital, J.P. Exit Valuation : $54B (IPO).

PYMNTS

JANUARY 22, 2018

And the company is not done expanding — it plans to find one or two new partners for the fresh kiosks in the San Francisco Bay area, according to Inc. Venture Capital Investment. They are continually redefining health and healthful eating experiences,” John Haugen, VP and general manager of 301, told NOSH. The Future.

CB Insights

FEBRUARY 11, 2020

Chief Innovation Officer, Salesforce (NYSE: CRM). Global Head of Digital Wealth Management, JPMorgan Chase (NYSE: JPM). CEO, Groww (backed by Ribbit Capital, Sequoia Capital India, and Y Combinator). See you in San Francisco ! Here’s our first batch of speakers on the lineup: CFO, SoFi (unicorn — $4.3B

CB Insights

APRIL 6, 2018

The following is a guest post by Paul Asel, managing partner at NGP capital. The estimated annual cost to own a car is $8500 across the US, and much higher in cities: about $12,000 in San Francisco and $15,000 in New York City, including parking, insurance, maintenance, gas, and tolls. However, cars are expensive to own.

PYMNTS

JUNE 1, 2017

Stripe, a San Francisco-based payment service provider that specializes in online transactions, is expanding its arsenal of financial products to cater to the needs of data-hungry businesses. Stripe is a leading innovator in the financial technology space.

Independent Banker

DECEMBER 29, 2015

Online consumer lender the Lending Club in San Francisco, founded in 2006 and now a publicly traded firm, focuses on helping consumers consolidate credit card debt. capital policy. He says that those lenders argue, “You’ll stymie innovation if you try to regulate us.”. Others cater exclusively to small businesses.

PYMNTS

SEPTEMBER 24, 2018

But then there are innovators who tempt us with their new ways of doing things. And in an innovation-intense environment, more is usually more — and out of step and out of date are just as good as broken. This is likely why we saw such a robust embrace of trying new things throughout the marketplace this week.

Fintech Labs Insights

MAY 16, 2017

Less than a month after announcing its new $105 million SoFi Prime Income Fund to help raise funds to issue loans, online lending innovator SoFi is making headlines again with the launch of SoFi Wealth. The new initiative, the company’s first digital wealth management offering, will allow investors in the U.S. Mike Cagney is CEO.

CB Insights

SEPTEMBER 21, 2017

Startups are addressing pain points such as medical record interoperability, data security, reimbursement, and pharmaceutical supply chain management, while corporates are launching initiatives to bring blockchain tech to healthcare. The company is initially tackling health claims management. supply chain management.

Fintech Labs Insights

MAY 6, 2015

Less than a week away from its Finovate debut in San Jose , wealth advisory technology innovator, Trizic has closed a $3 million seed funding round with Operative Capital. Operative Capital initially invested $1 million in Trizic, and this week increased its investment by another $2 million.

CFPB Monitor

AUGUST 22, 2016

Lynn Drysdale, Managing Attorney, Consumer Law Unit, Jacksonville Area Legal Aid, Inc., Paulina Gonzalez, Executive Director, California Reinvestment Coalition, San Francisco, CA. Arjan Schutte, Founder and Managing Partner, Core Innovation Capital, Los Angeles, CA. Jacksonville, FL. Ian Ayres, William K.

Jeff For Banks

JUNE 2, 2023

Finally, resolution of failing financial institutions requires that the deposit insurance fund be strongly capitalized with real reserves, not just federal guarantee.” To you, manage your interest rate risk. Who would’ve thought lending $1 million to a San Francisco cab driver to buy a house at 100% loan to value would go bad?

CB Insights

FEBRUARY 13, 2020

This growth has created major opportunities in the payments space, and companies like Stripe — the payments unicorn valued at a masive $35B — are hungry to capitalize on them. As a result of its product innovation efforts, Stripe has seen explosive growth in product adoption and valuation. A decade of online payments innovation.

PYMNTS

AUGUST 17, 2017

A separate survey from management consulting firm Bain & Co. Jamie Armistead, executive vice president of Digital Channels for Bank of the West , recently spoke with PYMNTS about how startups and tech are informing his company’s innovation strategy. Staying on Top of Customer Expectations. Staying on Top of Customer Expectations.

Gonzobanker

DECEMBER 17, 2021

This is an innovation-seeking franchise that has built a solid brand and never got over its skis in execution. Congrats to Randy and a great management team. Eric has always been a student of innovation, and now at Coastal, this fearless leader has spearheaded a number of high-profile banking-as-a-service partnerships.

Fintech Labs Insights

JUNE 14, 2016

The move will enable the bank to better serve companies outside of Europe, and comes less than a year after the innovative FI opened offices in the U.K. To lead operations in Dubai, Fidor Bank has hired Gé Drossaert (pictured) to serve as Managing Director. Munich-based Fidor Bank is expanding to Dubai.

PYMNTS

OCTOBER 1, 2018

By using funds managed by LCA to benefit its parent company, LCA and Laplanche failed to do so.”. We have full confidence in our new management team and we are a better company today.”. million Series C financing round led by Foundation Capital and joined by Morgenthaler Ventures, Norwest Venture Partners and Canaan Partners.

PYMNTS

APRIL 19, 2016

That’s not to say that Coachella is totally insulated from advertising that manages to push the right product to the right consumers at the right time. Palm Springs, Orange County, San Francisco, New York and Dallas).

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content