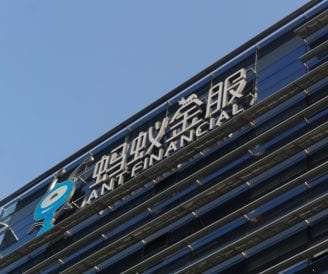

Ant Group Debuts Virtual Bank In Hong Kong Weeks After Filing IPO

PYMNTS

SEPTEMBER 28, 2020

Ant Bank, the virtual banking division of Hangzhou, China-based Ant Group , has launched banking services in Hong Kong, Fintech News reported. We set up Ant Bank with the intention of providing increasingly mature FinTech products and services to the Hong Kong market and to provide a new choice to people locally.”. billion yuan ($10.5

Let's personalize your content