Converting Libor Loans To SOFR Loans – A Guide

South State Correspondent

NOVEMBER 30, 2022

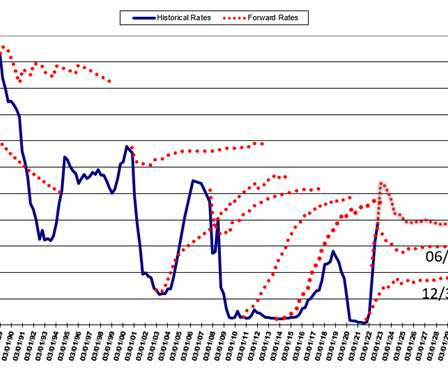

Banks have ceased using LIBOR to price assets and liabilities after 2021. The remaining LIBOR cash and derivative instruments will continue until June 30, 2023. Considerations for Converting Libor Loans to SOFR. When converting Libor loans to SOFR, term SOFR appears to be a suitable index consideration. Conclusion.

Let's personalize your content