Nuvemshop, Latin America's Shopify, Raises $30M

PYMNTS

OCTOBER 14, 2020

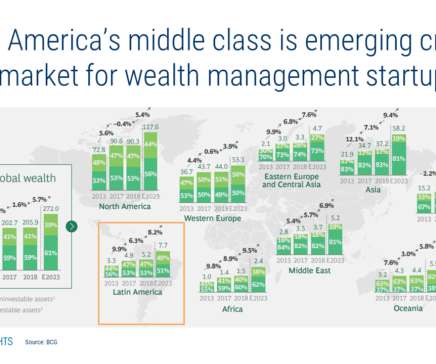

The four intended to start a new marketplace software product for the Latin America region. And the company plans to offer a wide diversity of financial services, with new lending services based on revenue added to the payment processing it already offers, according to reports.

Let's personalize your content