Banking Predictions 2024: Gray Skies Are Going to Clear Up (in 2025)

Gonzobanker

JANUARY 18, 2024

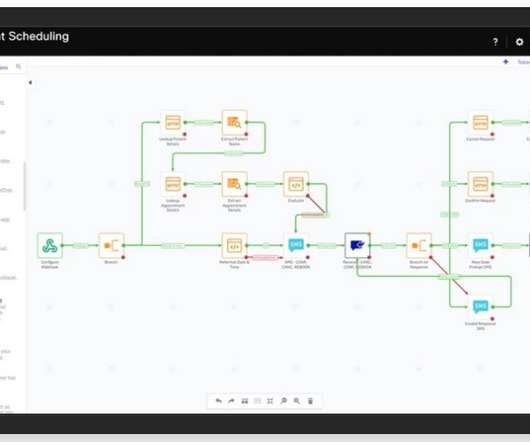

Regulatory headwinds, iffy economic conditions and a more conservative approach to tech innovation spending are combining to put a damper on BaaS growth. By the end of 2025, however, commercial RTP payments will start to grow more significantly as smart banks realize that’s where the opportunity (i.e., Big surprise, eh? money) is.

Let's personalize your content