1Q 2023 Loan Pricing Update

South State Correspondent

JANUARY 20, 2023

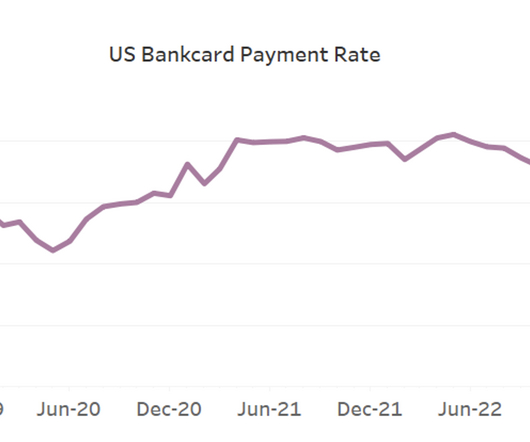

ROE Targets Moved up in 2023 As was the theme for most of 2022, the target risk-adjusted return on equity increased from 15% at the start of 2022 to 24% at the beginning of 2023. The other ultra-competitive sector was owner-occupied lending backed by real estate to medical professionals. coverage as their spread was too high.

Let's personalize your content