Deep Dive: Why Video-Based KYC Is Key To Seamless, Cost-Effective FI Onboarding

PYMNTS

DECEMBER 10, 2020

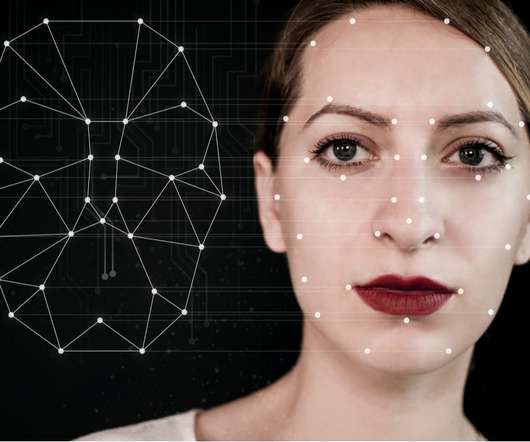

Video-based KYC is an effective digital technology used increasingly to confirm customers? This method allows banks and merchants to verify customers through video interviews and biometric authentication, which are checked against physical documents. Video verification is one way to ensure smooth experiences and build trust. .

Let's personalize your content