Alloy introduces new risk management solution

The Paypers

MARCH 1, 2024

US-based fintech company Alloy has announced the launch of a new risk management solution for Embedded Finance partnerships.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

The Paypers

MARCH 1, 2024

US-based fintech company Alloy has announced the launch of a new risk management solution for Embedded Finance partnerships.

Celent Banking

DECEMBER 13, 2016

Source: Oliver Wyman, Celent Celent, through its work with Oliver Wyman, estimates the cost to US financial institutions of undertaking due diligence and assessment of new third party engagements to be ~ $750 million per year. The top ten US banks average between 20,000 and 50,000 third party relationships.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Independent Banker

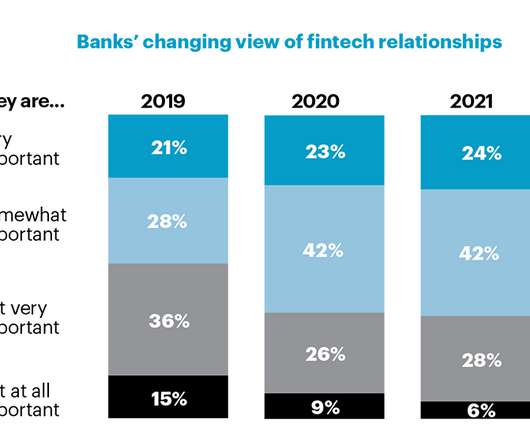

JANUARY 31, 2022

With consumer expectations seeming to evolve faster every year, community banks could consider partnering with a fintech to keep up with technological innovation. of bankers are either strongly interested in or already working with fintechs in digital account opening. The benefits of fintechs. By Elizabeth Judd. Quick Stat.

Abrigo

DECEMBER 17, 2021

Components of an effective fintech partnership If leveraging new technology is a priority for your FI, ensure these three elements are present for an effective fintech partnership. . Takeaway 2 When evaluating a fintech partnership, ask how the vendor will help with integration, training, and ongoing success.

Insights on Business

JANUARY 8, 2019

But what has this got to do with risk management I hear you ask? Well, one of the biggest potential uses of quantum computers is a simulation. The more complicated technical term is superposition, but let’s not worry about it at this stage. IBM 50Q: An IBM cryostat wired for a 50 qubit system. Live long and prosper.”.

PYMNTS

APRIL 16, 2019

Cross-border FinTech efforts have seen increasing participation from central banks and monetary authorities. The MOU dictates that the banks will train FinTech startups with an eye on cross-border transactions. The Fed And FinTech Firms. The money will be used to build engineering staff.

PYMNTS

OCTOBER 1, 2020

As banks look to streamline access to finance or make it easier to safely share financial information with apps, Barclays Business Banking and Wells Fargo are joining forces with FinTechs on digital initiatives. PYMNTS rounds up the latest partnerships and initiatives below. Barclays & Propel. Wells Fargo & Envestnet. “We

Gonzobanker

SEPTEMBER 21, 2023

Treasury management provider Dragonfly Financial Technologies launched independently from an ACI Worldwide sale. Alkami partnered with Clinc for conversational AI, Atomic for direct deposit switching and FINBOA for payment dispute management. Personal loan and credit card provider Avant secured funding from Ares Management Corporation.

Perficient

FEBRUARY 27, 2023

The payments industry is no different, and we’re quickly approaching a new intersection point due to the Real-time Payments’ movement into the US. These days, as the US prepares to embrace real-time payments in 2023, the intersection of real-time payments and automation has become a key point of discussion.

PYMNTS

JANUARY 13, 2021

Ingo Money CEO Drew Edwards recently told PYMNTS that “Historically, banks have viewed FinTechs through an ‘us versus them’ lens — and rightly so, because, in so many cases, the banks were disintermediated or relegated to become ‘dumb vaults’ for the FinTechs they partnered with. Consumerization Continues. “A

PYMNTS

DECEMBER 2, 2019

Singtel Innov8, TMI (Telkomsel Indonesia), Cathay Innovation, Kejora-InterVest, Mirae Asset Securities, Reinventure and DST Partners also participated in the “oversubscribed” funding round — one of the largest for a FinTech startup in Southeast Asia.

The Paypers

MAY 19, 2023

US-based Stearns Bank has partnered with risk management solutions provider Sardine to augment the former’s fintech programme and address regulatory and compliance requirements.

Abrigo

SEPTEMBER 11, 2023

Takeaway 2 AI can lead to more accurate and consistent outputs or predictions, better risk management, and improved customer experiences. Let us step back in time and look at the last 50 years. But the real lifestyle upgrade came when you had fintechs like Xoom and PayPal that made payments happen in near real-time.

PYMNTS

NOVEMBER 12, 2020

Visa Unveils FinTech Partnership Program In Europe. FinTech Partner Connect will “support new ways for businesses and consumers to seamlessly and securely pay, get paid, send money and more,” according to a representative for the company in an email announcing the effort. UK BaaS Railsbank Closes $37M Funding Deal To Support US Growth.

The Paypers

OCTOBER 11, 2023

US-based lending provider EDOMx has partnered with B2B SaaS fintech finbotsAI to enable credit risk management using AI.

Independent Banker

DECEMBER 1, 2021

The pandemic forced us to find new ways to interact with customers. Over the next 3-5 years, 82% of financial institutions expect to increase their partnerships with FinTechs, with an average return on investment of 20%. Benefits of FinTech partnerships. How to choose the right FinTech partner.

PYMNTS

MAY 18, 2017

The rise in B2B FinTech has complicated the picture of treasury management, forcing it to rethink its position in the enterprise. The more payment, cash management, cash flow forecasting, ERP and other digital platforms integrated, the more difficult it can be for a company to envision its own financial health across all of this data.

PYMNTS

NOVEMBER 6, 2018

Shell collaborated with Bloomberg on the solution, integrated into the Bloomberg Terminal, which is also available for use by other corporate treasury operations, the companies noted. The Bloomberg Terminal connects Shell with all our counter parties, providing straight-through processing (STP) into Shell’s treasury management system.”

PYMNTS

MAY 22, 2018

At the top of the list, according to reports, is incoming FinTech disruption, legislation like PSD2, market shifts stemming from Brexit and more. Among the speakers was Graham Taylor, Vodafone’s assistant treasurer, who emphasized the potential for PSD2 regulations to have a profound impact on corporate cash management and payments.

CB Insights

NOVEMBER 21, 2019

Finally, looking at Canadian “fintech” (financial technology) specifically, funding was up substantially in the first half of the year. Canadian fintech companies raised $251M through the end of H1’19, nearly double the $133M raised in H1’18. The 2019 Canadian fintech market map. Navigating the Canadian fintech market map.

Bobsguide

MARCH 21, 2022

Best Middle-Office Solution: CompatibL Risk Platform. FinTech Person of the Year: Alexander Sokol, CompatibL. Software Solution of the Year: CompatibL Risk Platform. Show us your support and vote for CompatibL here: [link]. Best Cloud-Native Computing Initiative: CompatibL Cloud Platform. Voting will close on April 22.

PYMNTS

MARCH 8, 2017

In fact, when it comes to FinTech companies, thinking “small” by focusing and serving a relatively small number of huge markets may provide the best opportunity to drive more impactful revenue with sustainable and profitable growth. Navigating the FinTech Waters. There’s more to thinking small than one might think.

PYMNTS

OCTOBER 5, 2020

4) to buy its FinTech competitor, SIA , for about 4.6 This is not the first mega deal involving FinTech companies. billion) to acquire Ingenico Group , the Paris-based technology provider of secure electronic transactions to create a FinTech dynamo. Nexi , the Italian digital payment company, agreed Sunday (Oct.

PYMNTS

OCTOBER 7, 2016

6) it has acquired a 100 percent ownership stake in FinTech startup Plati Potom. Plati Potom develops post-payment solutions for eCommerce and offline retailers, as well as data analysis and credit risk management tools. For us, QIWI is a strong and understanding strategic partner. QIWI announced on Thursday (Oct.

FICO

OCTOBER 24, 2017

FICO World is recognized as the foremost international conference on applications of predictive analytics and decision management technology. Key topics for the 2018 conference will include AI and machine learning, cybersecurity, risk management, customer engagement and innovative applications of decision management.

FICO

MARCH 6, 2019

Evergreen Finance London Ltd, a leading UK fintech that operates as MoneyBoat.co.uk , have recently selected FICO technology and analytics to automate lending decisions. Evergreen have purchased FICO® Decision Modeler , part of the FICO® Decision Management Suite , which will execute Evergreen’s credit evaluation strategies.

CB Insights

FEBRUARY 20, 2020

In 2018, companies from 31 countries and 19 categories — spanning payments, digital banking, insurance, and more — made it onto the CB Insights 2018 Fintech 250 list. Below, we dive into where the Fintech 250 Class of 2018 startups are now. Our call for submissions is now open for the third annual CB Insights Fintech 250 list.

Alex Jimenez

NOVEMBER 4, 2023

Money 20/20 USA has become the biggest FinTech gathering in the US. FinTech Revolution and AI: The overarching trend was the continued evolution and revolution in the FinTech industry, including the adoption of AI and emerging technologies. I had a chance to speak at the TerraPay booth about cross-border payments.

Let's Talk Payments

AUGUST 27, 2016

The term cash-replacement typically refers to a myriad of products such as debit cards, prepaid cards, credit cards, etc., that effectively will enable a transaction without cash or (almost) replace.

PYMNTS

MARCH 16, 2018

But APIs can offer a different strategic advantage, especially to B2B FinTechs, according to A.J. Remlinger, Project Manager — Solutions for Business at foreign exchange technology firm OANDA. We’re looking to partner with treasury management system [TMS] providers out there.

CB Insights

NOVEMBER 3, 2022

While insurtech funding has remained relatively flat quarter-over-quarter in 2022, insurers are still actively engaging with startups to improve their businesses — including addressing climate-related risks. . download the State of Fintech Q3 ’22 Report. First name. Company Name. Phone number.

FICO

FEBRUARY 12, 2018

For all the talk in the UK about disruptors and fintechs and new entrants to the credit market, and about how banks and card issuers need to manage customers in arrears, there’s one group that seems strangely absent from this focus: retailers. Give us a call. The post How Are UK Retailers Managing the £200 Billion Credit “Tick”?

William Mills

SEPTEMBER 27, 2019

Over half of the demos were new company or product debuts featuring business intelligence, chatbots, digital banking, employee benefits, financial planning, insurance, lending, payments, risk management, security, wealth management, and more. Here are a few key trends and event highlights stood out to us.

Insights on Business

JANUARY 22, 2018

To proactively respond to this uncertainty, financial institutions assume that the only way for their organization’s to reduce risk and improve compliance is to spend more. Topics that will be discussed are: How will FinTech innovation shape the compliance and risk management landscape for regulated firms?

PYMNTS

AUGUST 10, 2017

From user interface technology to security and risk management, the only constant in the financial space is that nothing stays the same for long. We now have three brands under us – UAE Exchange, Xpress Money and via a shareholder vehicle, Travelex. Are there advantages for consumers using a particular transaction method?

Fintech Labs Insights

MAY 18, 2016

In the case of Scalable Capital, what’s new and noteworthy about their effort to make investing easier is its proprietary risk management technology. Give average investors the same level of risk management as wealthier investors and watch the investment returns for individual investors improve. Stefan Mittnik.

Lars Markull

JUNE 14, 2020

This week two “access to X” API companies raised money: Firstly, the US startup Pinwheel provides access to payroll accounts and has raised 7 million USD from First Round Capital, Upfront Ventures and other investors. More than 82% people in the US get paid via direct debit from a payroll provider such as Gusto, Paychex or ADP.

Celent Banking

APRIL 18, 2016

Last week many of us at Celent were in New York attending our Innovation and Insight Day on April 13th. Citizens Bank, US. Santander, US. Bank of America Merrill Lynch, US. CBW Bank, US. Cash Management and Trade Finance. Cash Management and Trade Finance. Security, Fraud, and Risk Management.

The Paypers

MARCH 17, 2020

US-based fintech Integral has partnered with Western Union to employ eFX risk management technology across Western Union Business Solutions platform.

Lex Sokolin

DECEMBER 31, 2020

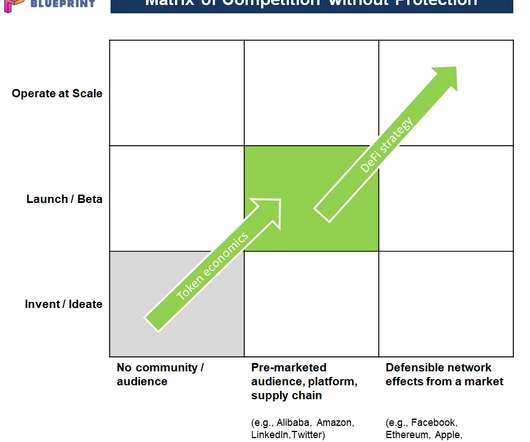

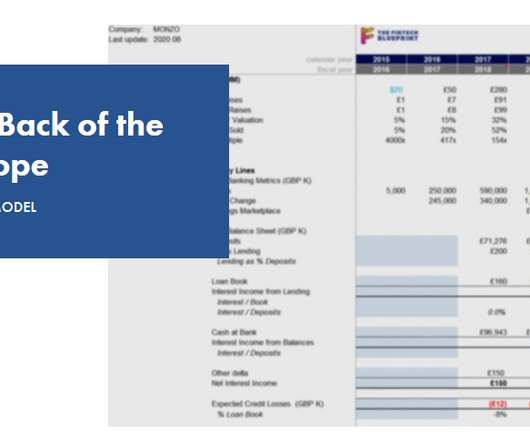

A Year in Financial Models, Fintech Valuations, Super Apps, Big Tech, Decentralized Finance, the Multiverse, Pandemic, Revolution, Crypto Art, and the Nature of the Universe Hi Fintech futurists — You should be out partying! Is Ant Financial the best Fintech in the world? Or rather, you should be inside, partying. Runner up?—?

Lex Sokolin

DECEMBER 31, 2020

A Year in Financial Models, Fintech Valuations, Super Apps, Big Tech, Decentralized Finance, the Multiverse, Pandemic, Revolution, Crypto Art, and the Nature of the Universe Hi Fintech futurists — You should be out partying! Is Ant Financial the best Fintech in the world? Or rather, you should be inside, partying. Runner up?—?

PYMNTS

MARCH 22, 2018

“In a very short time, Simility has come to be recognized as a thought leader in fraud and risk management,” said CEO and co-founder Rahul Pangam. Our customers, who span the spectrum from top FinTech innovators to Global Fortune 500 institutions, have validated this view by partnering with us to solve extremely hard problems.”.

Lars Markull

JUNE 14, 2020

This week two “access to X” API companies raised money: Firstly, the US startup Pinwheel provides access to payroll accounts and has raised 7 million USD from First Round Capital, Upfront Ventures and other investors. More than 82% people in the US get paid via direct debit from a payroll provider such as Gusto, Paychex or ADP.

PYMNTS

FEBRUARY 15, 2018

Players from the CU space are looking to use more data to serve and protect customers. The National Institute of Standards and Technology (NIST) recently announced it would place higher emphasis on external data sources when considering risk management. And in Ireland, Kilkenny-based IT service firm Bits.ie

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content