Fintechs launch SBA PPP platforms amid stimulus scramble

Bank Innovation

APRIL 3, 2020

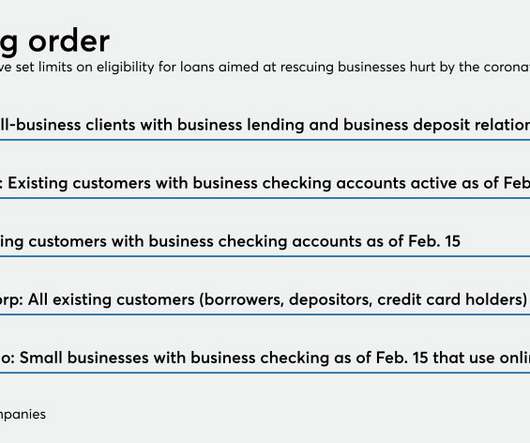

As banks scramble to stand up digital interfaces and participate in the SBA Paycheck Protection Program (PPP) that launched today, fintech providers are rolling out different technology platforms to help lenders process the flood of small business loan applications. The Payroll Protection Program, a major component of the “Coronavirus Aid, Relief, and Economic Security” Act, authorizes lenders to provide up to $349 billion in funds to […].

Let's personalize your content