Toast surpasses $100B in annualized payments

Payments Dive

NOVEMBER 15, 2022

The payments company that caters to restaurants reached that quarterly record after significant expansion this year.

Payments Dive

NOVEMBER 15, 2022

The payments company that caters to restaurants reached that quarterly record after significant expansion this year.

Cisco

NOVEMBER 15, 2022

Venmo, just like Google, has become a proper noun AND a verb. Venmo solved a problem of an individual wanting to pay another individual (or even small business) without having to use cash, check or even debit/credit card. Open banking made this possible. Open banking allows third-party financial services companies to access consumer banking, transaction, and other financial data via the secure use of APIs.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

NOVEMBER 15, 2022

When asked Monday how Fiserv would adapt to an economic downturn, CEO Frank Bisignano said the company knows what levers to pull “to manage the expense line.

CFPB Monitor

NOVEMBER 15, 2022

The CFPB has filed a certiorari petition with the U.S. Supreme Court seeking review of the Fifth Circuit panel decision in Community Financial Services Association of America Ltd. v. CFPB that held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S. Constitution. Given the daunting odds the CFPB would have faced in seeking to have the decision reversed by an en banc Fifth Circuit, it is not surprising that it chose to proceed directly to the Supreme Court.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

NOVEMBER 15, 2022

The founder of Payment Logistics will remain at the firm overseeing its employees in California.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankBazaar

NOVEMBER 15, 2022

Two different t erms , one often considered a doppelganger of the other. This article will set the record straight so that t hese two terms never leave y ou confused ! “ I think I should apply for a loan” -find us an adult on the face of earth who never had this thought. Countries, corporations, startups, you, me… From billions to a few thousand, we’ve all relied on a loan from financial institutions at various points in life when we were strapped for cash.

CFPB Monitor

NOVEMBER 15, 2022

Yesterday, a three-judge panel of the U.S. Court of Appeals for the Eighth Circuit granted a request to enjoin the Biden Administration’s federal student loan forgiveness program pending resolution of an appeal filed by state attorneys general of six states (Missouri, Arkansas, Nebraska, Iowa, Kansas, and South Carolina), whose challenge to the loan forgiveness plan had been dismissed in October for lack of Article III standing.

Banking Exchange

NOVEMBER 15, 2022

Plus: New faces at Merchants Mortgage, and First Republic expands wealth management division Management Feature Human Resources Financial Trends Lines of Business Feature3.

William Mills

NOVEMBER 15, 2022

In a world geared for speed and increased efficiency, there is no shortage of productivity techniques and tools to help us save time and complete more tasks each day. However, despite access to infinite technologies and methods to conserve time (e.g., cars, email, virtual meetings, etc.), we do not have much control over how our time plays out. Having an extensive workload and a perceived lack of control can quickly lead to feeling burned out.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Banking Exchange

NOVEMBER 15, 2022

A downturn could be the best time to pick up a good deal – but few banks are positioned to do so Management Feature Financial Trends M&A Community Banking Feature3.

BankInovation

NOVEMBER 15, 2022

Dominic Cugini, chief information officer of service digitization at KeyBank, has joined the speaker faculty for the Bank Automation Summit U.S. 2023. Cugini will speak on the panel “New approaches and techniques in RPA,” on Friday, March 3, at 9:05 a.m. ET at the Westin in Charlotte, N.C. The panel will discuss methods of designing […].

FICO

NOVEMBER 15, 2022

Home. Blog. FICO. Siron Financial Crime Solutions Are Moving from FICO to IMTF. FICO is transitioning its Siron ® compliance business to IMTF, a Swiss global leader in regulatory technology, and a partner in the Siron business for more than 20 years. FICO Admin. Tue, 07/02/2019 - 02:45. by TJ Horan. expand_less Back To Top. Tue, 11/15/2022 - 11:25. As we announced today, FICO is transitioning its Siron® compliance business to IMTF , a Swiss global leader in regulatory technology, and a partner i

BankInovation

NOVEMBER 15, 2022

Community banks can contend with their larger counterparts by leveraging artificial intelligence (AI)-powered chatbots to improve both customer experience and internal efficiencies. Virtual assistants save valuable time and resources by routing customers to the appropriate digital channels based on their inquiries, Murali Mahalingam, senior vice president of AI business at Eltropy, tells Bank Automation News […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Javelin Strategy & Research

NOVEMBER 15, 2022

Banner Section Home Rss.xml 2023 Trends & Predictions Javelin’s Trends & Predictions reports look at the coming year across the range of Javelin Strategy & Research’s practice areas—digital banking, fraud & security, payments, and wealth management—and highlight the compelling challenges and opportunities likely to emerge. Open Positions Accordian Reports Section 2023 Cryptocurrency Trends & Predictions Javelin Report Date: November 16, 2022 Authors: James Wester , Joel Hugentobler Research T

BankInovation

NOVEMBER 15, 2022

Huntington Bancshares’ online engagement and acquisition mix has grown significantly through technology investments and customer experience enhancements since the bank first embarked on its digital journey five years ago. The $179 billion Huntington’s digital checking acquisition increased to 46% this year, up 228% from 14% in 2017, according to the bank’s 2022 Investor Day presentation. […].

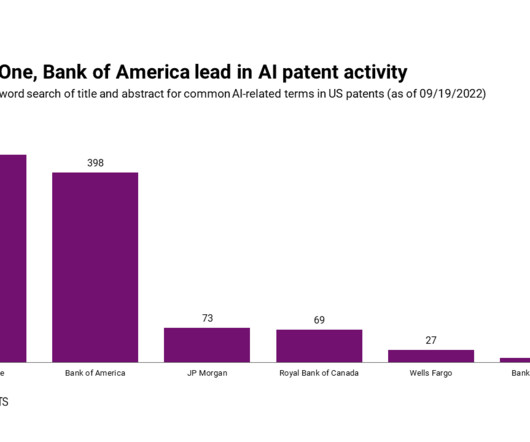

CB Insights

NOVEMBER 15, 2022

Patents are a key indicator of a bank’s AI strategy and R&D direction. For example, Capital One has applied for 40+ AI patents related to vehicles, reflecting its emphasis on its auto underwriting tool. Meanwhile, Bank of America, whose AI assistant has now crossed 1B user interactions, is continuing to apply for patents related to intelligent agents and user intent recognition.

American Banker

NOVEMBER 15, 2022

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Financial Brand

NOVEMBER 15, 2022

This article Banks Embrace ‘Earned Wage Access’ Pay Trend to Bolster Relationships appeared first on The Financial Brand. Citizens Bank, PNC and U.S. Bank all see fast-growing 'on-demand pay' appealing to gig workers, Millennials and hourly employees. This article Banks Embrace ‘Earned Wage Access’ Pay Trend to Bolster Relationships appeared first on The Financial Brand.

The Financial Brand

NOVEMBER 15, 2022

This article ‘Hug Your Haters’: Day 1 Takeaways from The Financial Brand Forum appeared first on The Financial Brand. Out of the gate like a pent-up racehorse, The Forum 2022's opening day was part homecoming party, part future-ready workshop. This article ‘Hug Your Haters’: Day 1 Takeaways from The Financial Brand Forum appeared first on The Financial Brand.

American Banker

NOVEMBER 15, 2022

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

South State Correspondent

NOVEMBER 15, 2022

the As interest rates go back up and volatility continues to remain high, banks’ cost of capital has undergone a significant shift up. Your cost of capital is essential to know for several reasons. Mostly, it gives your board and shareholders a yardstick in which to gauge a bank’s return. Produce over your cost, and you will be able to attract more capital.

FICO

NOVEMBER 15, 2022

Home. Blog. FICO. Next Best Actions / Next Best Offers – Four Pointers to Success. Next Best Actions / Next Best Offers balance the customer's interests and needs with your organization's business objectives, using mathematical optimization. FICO Admin. Tue, 07/02/2019 - 02:45. by Matt Cox. expand_less Back To Top. Tue, 11/15/2022 - 11:55. Right now, many banks and financial services firms are locked in a competitive arms race to deliver faster, smarter, suitably tailored experiences in a bid to

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content