BNPL extends to gas, groceries

Payments Dive

JUNE 1, 2022

Buy now-pay later providers have made their financing services more available for everyday purchases, offering consumers a tool to deal with inflation.

Payments Dive

JUNE 1, 2022

Buy now-pay later providers have made their financing services more available for everyday purchases, offering consumers a tool to deal with inflation.

Accenture

JUNE 1, 2022

Sustained disruption is reshaping the payments industry. Developments like new technologies, shifting consumer expectations, and the launch of central bank digital currencies are creating major changes. With changes come opportunities—but not all payments players are seizing them equally. In my previous post, we looked at some strategies that digital-native payments disruptors have used to out-grow….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Perficient

JUNE 1, 2022

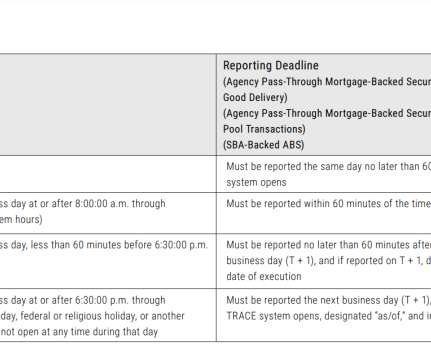

So far in our 6-part blog series explaining the intricacies of TRACE, we have defined TRACE reporting, detailed the prep work to be done in order to effectively report TRACE transactions , and reviewed considerations for alternative trading systems. Now, for part 4 of the series, we will delve into the details of when and by whom transactions should be reported.

Accenture

JUNE 1, 2022

Commercial banking customers value the human relationships they have with bank employees, who provide advice, support and warnings about potential problems. Customers are looking for relationships based on empathy, responsiveness, customer focus and efficient service. Advances in artificial intelligence (AI) and tools that analyze data from multiple sources to provide valuable insights can endow bank….

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

JUNE 1, 2022

As banks try to fend off competition from fintechs in merchant acquiring and processing, payments gateway NMI aims to capitalize by offering to bolster their services.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

JUNE 1, 2022

Ken Meyer, Truist divisional chief information officer and experience officer for consumer technology, experience and innovation, has joined the speaker faculty of Bank Automation Summit Fall for the panel “Business Intelligence, CRM and Automation: How to Improve Customer and Employee Experience and Overall Efficiencies” on Tuesday, Sept. 20, at 9 a.m.

CFPB Monitor

JUNE 1, 2022

The California Privacy Protection Agency (“CPPA”) scheduled a Board Meeting for June 8 th , in which it will be discussing and possibly taking action with regard to the much anticipated CPRA enforcing regulations. To facilitate this discussion, the CPPA included a draft of the proposed regulations as part of the meeting records. This draft comes in the form of a 66 page redline of the current CCPA regulations.

BankInovation

JUNE 1, 2022

Automated treasury payments solutions at Banc of California will be powered by Finexio, the companies announced last week. Finexio, an accounts payable fintech with previous buy-in from Mastercard and communications firm Nordis Technologies, received $1 million from Banc of California during a funding round. Now, Finexio will fuel embedded accounts payables processes the $9.6 billion […].

CFPB Monitor

JUNE 1, 2022

We are pleased to report that Ballard Spahr’s Consumer Financial Services Group has once again received the highest national ranking from Chambers USA: America’s Leading Lawyers for Business. The Group was ranked in the highest tier nationally in three categories: Compliance, Litigation, and Enforcement & Investigations. Enforcement & Investigations was added by Chambers USA last year as a new category for Financial Services Regulation: Consumer Finance.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

ATM Marketplace

JUNE 1, 2022

DPL has developed tools and features as part of their managed wireless service, designed to help ATM operators improve cash management and logistics.

The Paypers

JUNE 1, 2022

The Central Bank of Ghana (BoG) has announced it granted Vodafone Cash and CalBank customers the opportunity to test its online version of its digital currency (CBDC), the eCedi.

ABA Community Banking

JUNE 1, 2022

The index, formed in 2003, includes 288 community banks and represents all Nasdaq-listed banks and savings associations except the 50 largest banks. The post Eight Banks Added to ABAQ Index appeared first on ABA Banking Journal.

The Paypers

JUNE 1, 2022

South African financial services group Sanlam has bought a controlling interest in payment solutions provider Q Link, its first fintech investment.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

CB Insights

JUNE 1, 2022

TransferMate , an international payments and money transfer company, has raised $70M in funding from the Railway Pension Trustee Co. Ltd. (Railpen). <span data-sheets-value='{"1":2,"2":"<div class="cbi-cta-shortcode-wrapper"><div class="cbi-cta-shortcode-content"></div><div class="cbi-cta-shortcode-forms" ><div class="cta has-desktop"><div class="cta-desktop center-copy "><h4&

The Paypers

JUNE 1, 2022

The Euro Banking Association (EBA) has released a report on the opportunities Open Banking provides for improving financial services offered to small and medium-sized enterprises (SMEs).

CB Insights

JUNE 1, 2022

Assembled , a workforce management tool for customer support teams, has raised $51M in a Series B that drew participation from Basis Set Ventures, Emergence Capital, and New Enterprise Associates. the state of venture report. Download our free report to get the TL;DR on what you need to know about venture funding and trends in Q1 2022. First name. Last name.

The Paypers

JUNE 1, 2022

Brazil’s taxation body, the Federal Revenue of Brazil (RFB), has passed a law that will require investors to pay personal income tax when they exchange one digital currency for another.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

JUNE 1, 2022

The Monetary Authority of Singapore (MAS) has announced the commencement of Project Guardian, a collaborative initiative with the financial industry that seeks to explore the economic potential and use cases of asset tokenisation.

The Paypers

JUNE 1, 2022

China Bank has launched China Bank START, a mobile phone app that helps non-China Bank customers open a new account.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

The Paypers

JUNE 1, 2022

Ecommerce platform eBay Australia has announced it expands its seller refurbished programme, stating that sellers who are not part of it will be restricted from listing items in categories such as ‘Seller Refurbished’

The Paypers

JUNE 1, 2022

US-based mobile authentication platform Incognia has announced it raised USD 15.5 million Series A funding to support growth and counter Identity fraud.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content