Demand For Faster Payments Skyrockets

PYMNTS

MAY 22, 2020

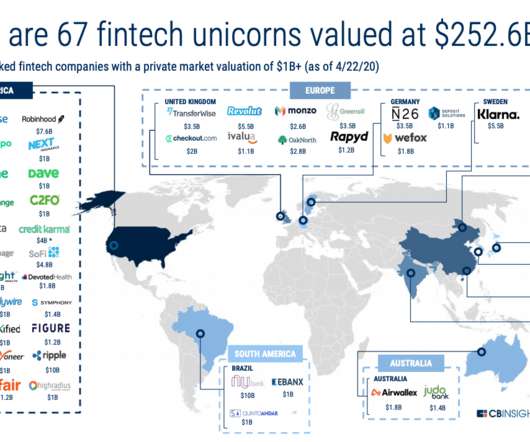

If you want to know how consumers feel about faster payments, talk to the millions of Americans who still have not received stimulus money as of mid- to late-May. The U.S. real-time payments void has hurt commerce, too, as PYMNTS research finds that close to 39 percent of small to mid-sized businesses (SMBs) have reduced payrolls to help relieve cash flow stress, and nearly 30 percent simply went under.

Let's personalize your content