Data – The Lifeblood of Intelligence Automation

Perficient

SEPTEMBER 21, 2023

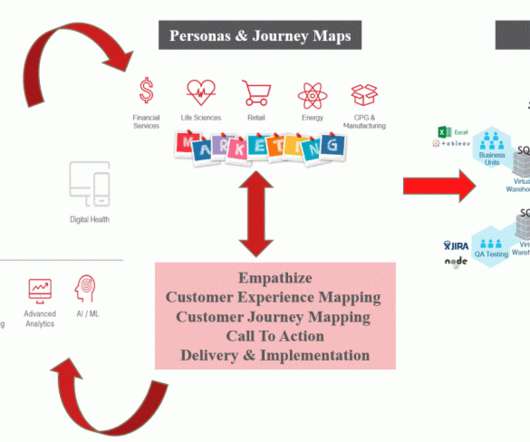

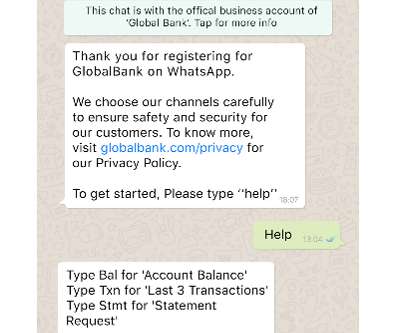

The Data: The Gas That Makes the AI Go What good is a stand-alone AI tool for businesses if it isn’t grounded in trusted, contextual data? If the tools we use for intelligence automation are not built around our customers, we will not be providing a truly personalized user experience.

Let's personalize your content