Silicon Valley Bank Failure – Lessons in Interest Rate Risk Management

South State Correspondent

MARCH 13, 2023

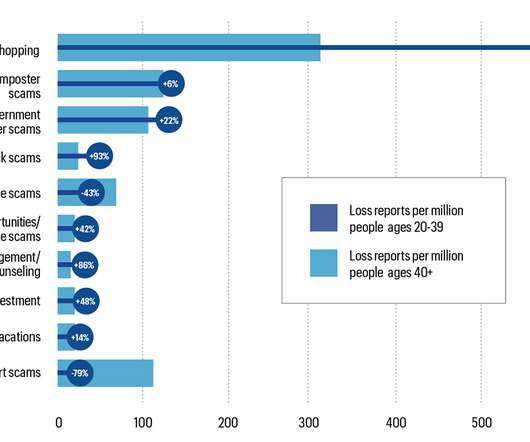

That fact makes the bank’s deposits less sticky and subject to outflow at any sign of insolvency. Equally important is the bank’s securities duration, as shown in the graph below. Approximately 56% of the bank’s securities had repricing greater than 15 years. at the end of 2022, with $2.4B

Let's personalize your content