How banks can reimagine a winning loyalty strategy

Accenture

AUGUST 28, 2023

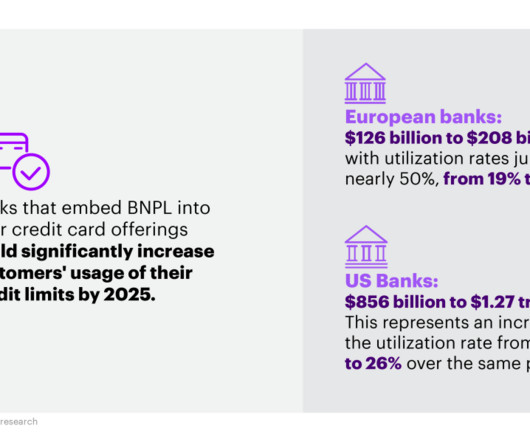

How loyal are your customers? And do they feel truly rewarded for their ongoing relationship with your bank? According to recent Accenture research, banking customers view loyalty as a two-way street: they are open to being loyal to one primary bank, but they want their bank to recognize and reward this loyalty. And while the… The post How banks can reimagine a winning loyalty strategy appeared first on Accenture Banking Blog.

Let's personalize your content