Community banks’ net income, loan balances increase in 2014

Abrigo

MARCH 9, 2015

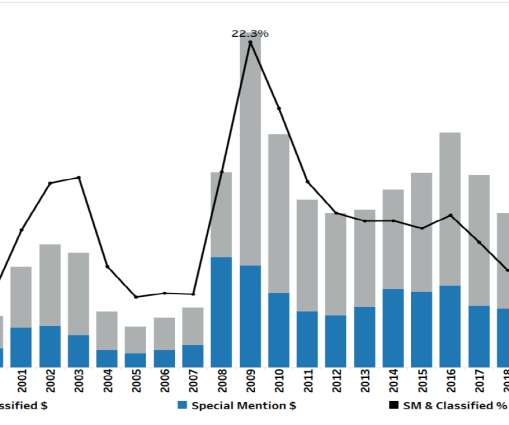

The latest FDIC Quarterly Banking Profile was just released and the industry continues to be led by the nation’s community banks. The positive trends from the third quarter of 2014 continued for the industry sub-set. During the fourth quarter of 2014, it rose $1 billion to reach $17.2 Small loans to businesses up 3.4

Let's personalize your content