California AG warns smaller banks, credit unions on penalty fees

American Banker

FEBRUARY 24, 2024

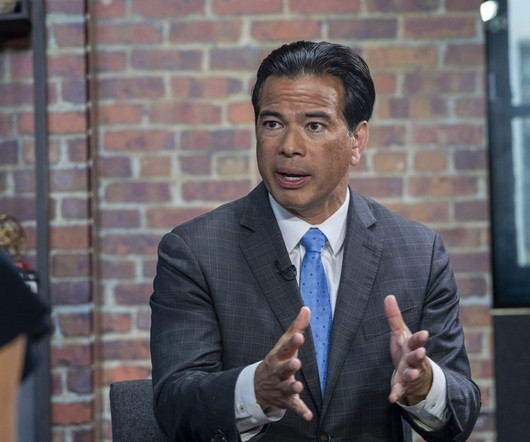

Surprise overdraft fees and charges incurred by consumers who cash bad checks likely violate the law, state Attorney General Rob Bonta said. His message was especially notable because it was aimed at smaller institutions that have gotten less scrutiny from Washington.

Let's personalize your content