Five principles for Canadian banks wanting to build human connections in a digital age

Accenture

MARCH 29, 2021

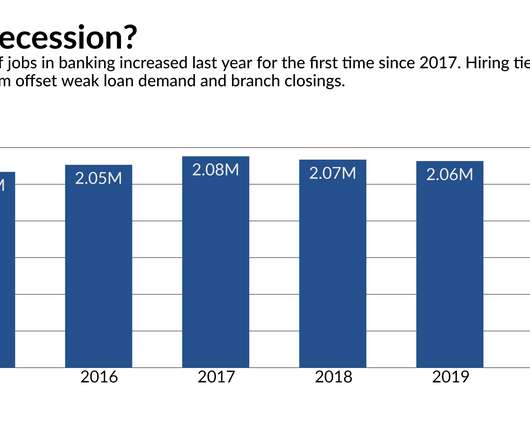

Canadian banks appear to be facing a paradox. The COVID-19 pandemic has kicked the uptake of digital banking into hyperdrive. Fifty percent of consumers now interact with their bank through mobile apps or websites at least once a week, compared to 32 percent in 2018. While this acceleration of digital interaction can drive cost efficiency,…. The post Five principles for Canadian banks wanting to build human connections in a digital age appeared first on Accenture Banking Blog.

Let's personalize your content