US Bank deploys smart assistant to boost digital banking

Payments Dive

JULY 24, 2020

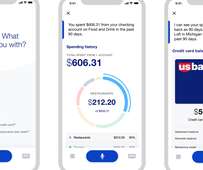

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

Payments Dive

JULY 24, 2020

US Bank is deploying natural language processing and AI-based technology to move more of its retail banking business onto the mobile banking app.

Perficient

JULY 24, 2020

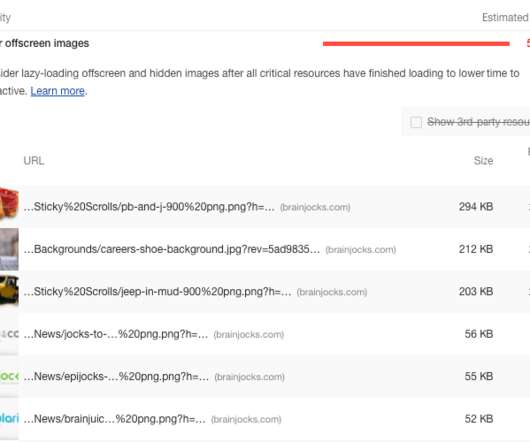

When chasing down performance problems on a website, you’ll often times hit an error around deferring offscreen images. This warning occurs when you have imagery “below the fold” (e.g., the area you must scroll to see) loading on your webpages. This problem is especially rampant in CMS systems where you’re never quite sure what the content authoring team is assembling.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accenture

JULY 24, 2020

For leading incumbent banks, Open Banking is not just a regulatory imperative. It’s a new revenue opportunity and a source of competitive advantage that can be captured by making the right power plays in the application programming interface (API) economy. But what exactly is the API economy? Gartner describes it as “an enabler for turning…. The post Beyond compliance—the new API economy appeared first on Accenture Banking Blog.

Perficient

JULY 24, 2020

It should be no surprise to hear that Healthcare Organizations (HCO’s) of all kinds are moving to the cloud. I see most of our provider and payor clients, making significant investments. The platforms they use mostly match F orrester’s Enterprise Health Cloud Wave from Q3 last. Yes, it’s three-quarters old but still relevant. If you read the actual report, you’ll see that each vendor has specific strengths.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

PYMNTS

JULY 24, 2020

Megamalls are having mega problems. The two largest U.S. malls — Minnesota’s Mall of America and New Jersey’s American Dream mall — are struggling, with the company that owns both recently skipping a third straight payment on the Minnesota property. Located in Bloomington, Minn., the Mall of America features not only 500 stores, but also some 28 amusement-park rides, an aquarium and more.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

PYMNTS

JULY 24, 2020

When Indochino launched in 2007, the company wasn’t out to create a new template for the entire retail sector, just a better product with better prices and a better buying experience. But four months into a pandemic that has turned the traditional retail business model inside out, the company looks like it could teach all of retailing a new paradigm — a showroom model with little inventory and appointment-only viewing.

Bobsguide

JULY 24, 2020

The UK Financial Conduct Authority’s (FCA’s) delay of the Senior Managers and Certification Regime (SMCR) may grant new opportunities for tech providers, but the long term impact on regtech solutions is uncertain. “One of the challenges is if firms build themselves that initial.

PYMNTS

JULY 24, 2020

Hundreds of thousands of Instacart customers are having their personal data sold on the dark web, including the last four digits of their credit cards, and the data could include people who used the popular delivery app as recently as this week, according to a BuzzFeed News report. There were sellers offering data from what could have been 278,531 accounts, although some may have been duplicates or fake, the report noted.

BankBazaar

JULY 24, 2020

So you’ve never taken a loan and are wondering how to build your Credit Score? Read on and discover alternative ways to create a credit history for yourself. Today, the Credit Score has become a vital part of the banking world. Lenders swear by it and consumers want to stay updated with it. There’s no doubting its importance and significance in today’s credit market.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

PYMNTS

JULY 24, 2020

Well, now what? That’s the question all companies are asking as they internalize the impact of the shift to digital on their customers, their businesses and their future. The challenge — particularly for retail — is getting clarity around that “next normal” for businesses, PYMNTS CEO Karen Webster noted in a recent discussion with Brett Narlinger , head of global commerce at Blackhawk Network.

BankDeals

JULY 24, 2020

Connecticut Community Bank, N.A. is currently offering an 18-month CD with the highest rate in Connecticut. Minimum opening deposit is $500. Also available as an IRA CD.

PYMNTS

JULY 24, 2020

One of the biggest differences between a bank and a credit union (CU) is that unlike a for-profit bank, a CU is owned by its members. It’s a model based on the concept of collaboration and cooperation, two ideals that have become instrumental in the financial services arena’s payments innovation efforts. Yet CUs are also typically local institutions servicing close-knit communities, so taking on a leadership role within the global payments innovation ecosystem may not seem like the m

TheGuardian

JULY 24, 2020

Malaysian finance minister hails return of ‘assets that rightfully belong to the people’ Goldman Sachs has reached a $3.9bn (£3.1bn) settlement with the Malaysian government over the 1MDB corruption scandal. The deal struck by the Wall Street bank, which allegedly failed to act while $4.5bn was looted from its client, Malaysia’s sovereign wealth fund 1MDB, involves a cash payment of $2.5bn and a guarantee to recover $1.4bn in assets invested with the fraudulently diverted money.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

PYMNTS

JULY 24, 2020

Instacart , the U.S. and Canadian online grocery delivery service, blamed reused passwords for the recent account hacks that led to the theft of its customers’ personal data that landed on the dark web. In a post on its website, Instacart said its investigation concluded the San Francisco-based company was not compromised. Instead, Instacart said hackers used credential stuffing, a practice in which usernames and passwords stolen from other sites are used to hack into other accounts.

ATM Marketplace

JULY 24, 2020

Face masks are mandatory now at many retail stores and restaurants as a defense against contracting the coronavirus. But for banks, mandating masks can be a little trickier.

PYMNTS

JULY 24, 2020

Britain’s stores have become the envy of the retail world. Reuters reports retail sales returned to near pre-COVID-19 lockdown levels last month when so-called non-essential stores in England reopened. In June, sales volumes increased by 14 percent from May, surpassing forecasts in a Reuters poll of economists. Combined clothing and footwear sales swelled by 70 percent as retailers put the recent slump in the rear view mirror.

BankInovation

JULY 24, 2020

As the COVID-19 pandemic alters the world, financial services are reacting in turn. The tech-focused market research company Forrester recently reported in “The New Unstable Normal: How COVID-19 Will Change Business and Technology Forever,” that the effects of the pandemic could be permanent. In the short term: 1. Consumers will continue to gravitate […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

PYMNTS

JULY 24, 2020

Not unlike the Terminator, fraudsters never seem to sleep or stop in their reprehensible pursuits. Some work in rings and syndicates that span the globe, and they take theft seriously. So must good actors. PYMNTS’ July 2020 Preventing Financial Crimes Playbook , done in collaboration with NICE Actimize , examines the cybertheft menace from a variety of angles, with an eye on COVID-era scams.

BankInovation

JULY 24, 2020

The rise in e-commerce has pushed Wells Fargo to begin development on a gateway product for business clients that will support international transactions online, Colleen Taylor, head of merchants services at the bank, told Bank Innovation. “We’re finding that in an e-commerce environment, you can sell around the globe and you need a capability to […].

PYMNTS

JULY 24, 2020

A growing number of consumers coping with the current financial downturn are turning to buy now pay later (BNPL) offerings that allow them to pay for everything from essential groceries to luxury expenses in installments. Recent research shows that almost one-third of customers in the U.S. have BNPL accounts, and the trend is gaining popularity around the world. .

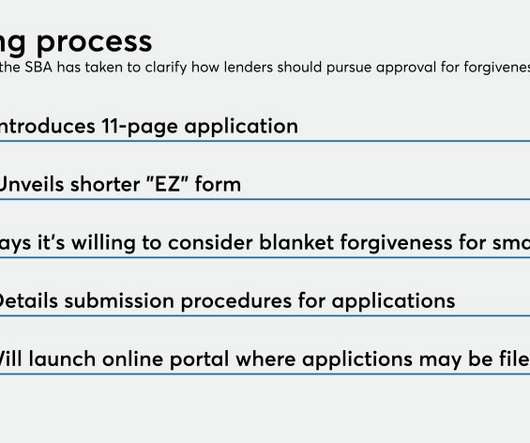

American Banker

JULY 24, 2020

A new Small Business Administration notice explains what steps lenders must take to seek approval of their forgiveness decisions under the Paycheck Protection Program. But lenders say lawmakers and regulators must do more to cut red tape.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

PYMNTS

JULY 24, 2020

As retailers seek to prevent staffers and shoppers from arguing, the requirements of major merchants that shoppers wear masks in U.S. brick-and-mortar stores are only so effective. Walmart , along with Walgreens, Home Depot and others, indicates that the retailer will still allow non-mask-wearing customers to transact, CNN reported. The federal government, in addition to a number of local and state governments, does not require mask-wearing.

ATM Marketplace

JULY 24, 2020

"Transactec, the Future of Transaction Technology," sponsored by Burroughs, explores the future of transaction technology. Elliot Maras, editor of Kiosk Marketplace, interviews Nick Spohn, senior director of business development at Burroughs.

PYMNTS

JULY 24, 2020

Synthetic identity fraud is costing companies heavily, with $14.7 billion lost to this type of crime in 2018 alone. This is a particularly subtle and nefarious kind of attack, in which bad actors create fake identities using real details stolen from different consumers. The result is a persona that often holds up against financial institutions’ (FIs’) traditional verification methods.

Payments Source

JULY 24, 2020

British Airways owner IAG SA renewed an air-miles deal with credit-card giant American Express Co., swelling the group’s coffers as the coronavirus crisis weighs on travel demand.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content