Whole Foods expands use of Amazon One paytech

Payments Dive

AUGUST 15, 2022

After rolling out the bio-authentication and payment technology to a handful of stores earlier this year, the grocery chain will add it to 65 locations in California.

Payments Dive

AUGUST 15, 2022

After rolling out the bio-authentication and payment technology to a handful of stores earlier this year, the grocery chain will add it to 65 locations in California.

Accenture

AUGUST 15, 2022

Is it fair to describe the workplace culture at the typical bank today as a competitive disadvantage? That depends on each bank’s particular situation. But Accenture’s cross-industry research, discussed earlier in this blog series, has found that the workplace culture at many banks suffers by comparison to many other organizations. This is a significant drawback….

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 15, 2022

The banking-as-a-service company wants to expand its reach as it spins off from the Central Bank of Kansas City.

South State Correspondent

AUGUST 15, 2022

Competition is intense, and every bank is looking for a competitive advantage. Better products, faster service, or insightful advice can translate into additional loans, better credit spreads, or extra fee income. Sometimes just a graphics tool can help a banker win more loan business. At SouthState, our commercial lending teams use an online proposal generator, and we make that same app available to any community bank.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Payments Dive

AUGUST 15, 2022

New digital integrations could differentiate Block-owned Square within an increasingly competitive point-of-sale and fintech category.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

BankInovation

AUGUST 15, 2022

Millennials and Gen Z customers are opting for a frictionless banking experience through automation in digital payments, loan approvals and money transfers. “If I’m a banker looking for ways to not only attract but retain the next generation, I need to make sure I have the right products and services,” Bryce Deeney, chief executive at […].

South State Correspondent

AUGUST 15, 2022

The reality is that banks don’t think from the customer’s perspective enough. The customer experience is horrible for many bank processes. Bankers often think from the bank’s perspective or from the regulator’s perspective. Not understanding your customer can lead to a brand and products misaligned with the customer’s needs resulting in an erosion of a bank’s competitive position.

CFPB Monitor

AUGUST 15, 2022

In an active week for federal regulators, the Federal Trade Commission (FTC) joined the CFPB in announcing important initiatives that may change privacy and data security practices in major ways. On August 11, the FTC released its Advanced Notice of Proposed Rulemaking , seeking public input on a host of questions relating to what it describes as “commercial surveillance”—or “the business of collecting, analyzing, and profiting from information about people”—in order to determine whether to i

South State Correspondent

AUGUST 15, 2022

Competition is intense, and every bank is looking for a competitive advantage. Better products, faster service, or insightful advice can translate into additional loans, better credit spreads, or extra fee income. Sometimes just a graphics tool can help a banker win more loan business. At SouthState, our commercial lending teams use an online proposal generator, and we make that same app available to any community bank.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

The Paypers

AUGUST 15, 2022

Provider of cloud-based ecommerce solutions ChannelAdvisor has announced its integration with Shopee , one of the most popular ecommerce platforms in Southeast Asia and Taiwan.

BankInovation

AUGUST 15, 2022

TD Bank’s head of integrated sales and advice for consumer distribution, Chris Yancey, has adapted his approach to relationship banking to meet the needs of both in-branch and mobile banking clients based on personal preferences collected through the bank’s customer relationship management (CRM) platform. The bank recently launched several technology initiatives, including its Next Evolution […].

The Paypers

AUGUST 15, 2022

Stablecoin provider Circle has announced its intentions to fully support Ethereum ’s shift to a proof-of-stake (PoS) chain following the highly anticipated merge event slated for 19 September 2022.

BankInovation

AUGUST 15, 2022

Great Southern Bank has selected core provider Fiserv to overhaul its digital banking and payments experience. The partnership allows the $5.6 billion Great Southern Bank to use DNA, Fiserv’s real-time account processing platform, to streamline customer interactions with tellers, allow mobile deposits through the bank’s app, and use its open APIs to integrate the bank’s […].

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

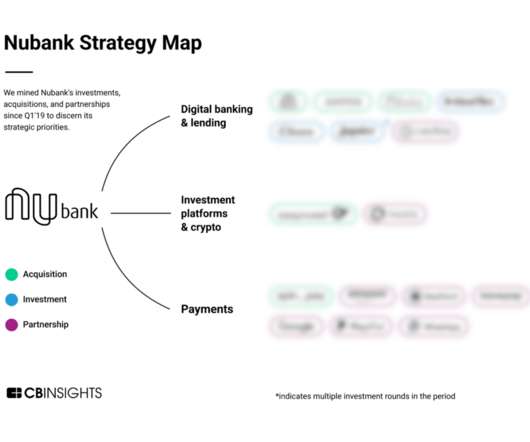

CB Insights

AUGUST 15, 2022

Brazil’s Nubank has its sights set on disrupting Latin America’s financial services. Since its founding in 2013, the challenger bank has grown its user base rapidly — reaching 60M customers as of May 2022, up 61% year-over-year. It notched $877M in revenue in Q1’22, with a gross profit margin of 34%. In 2011, only 56% of Brazilian adults had bank accounts.

The Paypers

AUGUST 15, 2022

ANZ Bank New Zealand has selected financial technology provider FIS to modernise its core banking capabilities.

The Paypers

AUGUST 15, 2022

American ride-hailing operator Uber has announced it is shutting down its free loyalty programme, Uber Rewards, with plans to focus on its subscription-based Uber One membership.

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Banker

AUGUST 15, 2022

SEBI’s new regulatory plans for the corporate bond market have the best of intentions, but risk impeding much-needed growth. James King reports.

The Paypers

AUGUST 15, 2022

The Australian Competition and Consumer Commission (ACCC) has announced it does not oppose Woolworths ’ proposed acquisition of MyDeal , following an extensive review to prevent monopole in the industry.

The Paypers

AUGUST 15, 2022

Czech Republic-based Peccala has partnered with Lithuania’s global ID verification company iDenfy to safeguard its user-friendly crypto platform with remote identity verification.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

AUGUST 15, 2022

Formerly known as Transferwise, fintech Wise has introduced its new INTERAC e-transfer request money feature to its users in Canada, providing a more convenient way to move money into their Wise wallets.

The Paypers

AUGUST 15, 2022

Canada-based web platform Get App has issued a survey revealing that most Quebecers have experienced fraud while shopping online, and that 93% worry about its data security.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content