FIS CEO exits earlier than expected

Payments Dive

DECEMBER 15, 2022

In a change of plans for the payments processor, Gary Norcross will hand off the CEO title to Stephanie Ferris earlier than expected and won’t become executive chairman.

Payments Dive

DECEMBER 15, 2022

In a change of plans for the payments processor, Gary Norcross will hand off the CEO title to Stephanie Ferris earlier than expected and won’t become executive chairman.

SWBC's LenderHub

DECEMBER 15, 2022

Without a doubt, the economic story of the past year has been the highest inflation in decades. Not only is it impacting current financial and economic activity, but it is dominating the outlook as well. In short, whatever happens with inflation will determine the trajectory of the economy over the next year and a half.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

DECEMBER 15, 2022

Milwaukee's city council unanimously approved creating a tax increment financing district to provide a grant for the company's new downtown headquarters.

CFPB Monitor

DECEMBER 15, 2022

The Federal Reserve System, through its Consumer Compliance Outlook platform, recently hosted its annual Fair Lending Interagency Webinar.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Payments Dive

DECEMBER 15, 2022

While autonomous checkout can speed up shopping trips and let employees take on new tasks, it doesn’t come without its frustrations, experts say.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

Payments Dive

DECEMBER 15, 2022

Credit card originations are expected to peak in 2022 before cooling down in 2023, TransUnion said.

CFPB Monitor

DECEMBER 15, 2022

PayActiv, which as the first EWA provider began an EWA program about 13 years ago, partners with employers to offer their employees EWA. We first discuss what EWA is, the structure of the employer model used by PayActiv and other.

Commercial Lending USA

DECEMBER 15, 2022

Fix and flip loans are short-term, real estate loans designed to grow the business of a real-estate investor for making a purchase, renovate & sell it for a good profit.

CFPB Monitor

DECEMBER 15, 2022

On December 7, 2022, the CFPB issued a report recommending that creditors proactively provide Servicemember Civil Relief Act (“SCRA”) interest rate benefits to eligible customers, bypassing the statute’s requirements of a written request from the servicemember and proof of military.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

BankUnderground

DECEMBER 15, 2022

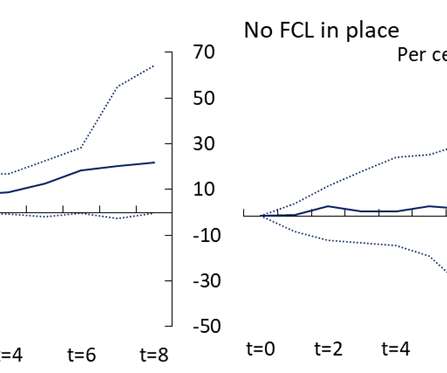

Daniel Christen and Nicola Shadbolt. Geoeconomic fragmentation is one of the greatest risks to the international monetary and financial system at present, particularly since Russia’s war of aggression against Ukraine. Fragmentation is likely to have wide-ranging implications for the global economy, including increasing the volatility of capital flows and exposing gaps in the global financial safety net (GFSN).

The Paypers

DECEMBER 15, 2022

SeedOn , a Romania-based blockchain crowdfunding platform, has unveiled several new features to its wallet, SeedOn Finance, ahead of the upcoming launch of its equity crowdfunding platform.

FICO

DECEMBER 15, 2022

Home. Blog. FICO. Our Scams Model Just Won an Award for Machine Learning. Credit & Collections Technology Awards recognize our scams model with the award for Machine Learning - here's why. Saxon Shirley. Wed, 05/25/2022 - 03:43. by Scott Zoldi. Chief Analytics Officer. expand_less Back To Top. Mon, 12/19/2022 - 11:30. As scams grow worldwide – scams grew by 30% in two years in the UK and by 18% from 2020 to 2021 in the US – financial services institutions are looking for new tools to detect and

The Paypers

DECEMBER 15, 2022

Passwordless authentication provider Keyless has partnered with identity proofing and compliance solutions provider Jumio to help financial institutions fight account takeover fraud.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

DECEMBER 15, 2022

Chief financial officers and treasurers are feeling squeezed in today’s market as they juggle multiple priorities, and they can look to technology and automation to relieve some of that burden. Investing in technology can help companies reduce costs, manage growth and improve operational efficiencies — but 58% of companies don’t have a formal digital transformation […].

TrustBank

DECEMBER 15, 2022

You may recall that in 2021 Washington state passed legislation to implement a 7% capital gains tax on certain asset sales, with the tax applying to profits that exceed $250,000. The assets subject to this tax are, in general, stocks, bonds, business interests, and tangible property, but not real estate. There are actually quite a few asset classifications that are exempt from this tax, so check with your tax preparer.

BankInovation

DECEMBER 15, 2022

Wealth management provider Fieldpoint Private has launched Fieldpoint Private Advisor Banking Services, a platform that will enable transaction transparency for registered investment advisor (RIA) firms outside of the bank. The new software suite at the $1.4 billion private bank runs on multiple technologies including AI, identity management and data management in a Microsoft Azure cloud […].

The Paypers

DECEMBER 15, 2022

UK-based fintech Payrow has launched services that support UK startups in tracking and analysing financial flows.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

Image Works Direct

DECEMBER 15, 2022

As part of our educational webinar series, we recently tackled the best strategies and tactics for multi-channel marketing, so you get the most out of your time and budget.

The Paypers

DECEMBER 15, 2022

The European Banking Authority (EBA) has published its roadmap outlining the objectives and timeline for delivering mandates and tasks around sustainable finance and ESG risks.

The Paypers

DECEMBER 15, 2022

Money transfer company Tempo France has partnered with all-in-one verification platform Sumsub to remain complaint with regulations and offer a better customer onboarding experience.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

American Banker

DECEMBER 15, 2022

The Paypers

DECEMBER 15, 2022

Canada-based fintech company Nuvei has extended its partnership with iGaming operator Holland Casino to power the latter’s online offering with instant payouts.

American Banker

DECEMBER 15, 2022

The Paypers

DECEMBER 15, 2022

UAE-based mobile banking solution NOW Money has partnered with ThetaRay to implement its cloud-based anti-money laundering (AML) solution for transaction monitoring.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

Let's personalize your content