Circular Board, Mastercard unveil small business card

Payments Dive

AUGUST 16, 2022

As a slew of fintechs try to capture small business customers, Circular Board’s Hello Alice brand is targeting entrepreneurs from marginalized backgrounds.

Payments Dive

AUGUST 16, 2022

As a slew of fintechs try to capture small business customers, Circular Board’s Hello Alice brand is targeting entrepreneurs from marginalized backgrounds.

South State Correspondent

AUGUST 16, 2022

China Weakness Has Treasury Prices Higher. A trio of reports out of China overnight suggest the second largest global economy has hit another soft patch and that has risk assets on the back foot this morning with Treasuries in the green. Retail sales, industrial production and investment all slowed in July and the jobless rate for the 16-24yr old cohort hit a record high of 19.9%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

AUGUST 16, 2022

Paysign aims to boost its prepaid card services for consumers shouldering the high cost of pharmaceuticals by offering drugmakers transparent pricing for such services.

ATM Marketplace

AUGUST 16, 2022

Buy now, pay later (BNPL), more than a just a modern version of layaway, is trending with consumers and gaining traction with major brands, retailers, and credit card issuers. More than 60% of online consumers have used a BNPL program and 38% of users say BNPL will eventually replace their credit cards.

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

TheGuardian

AUGUST 16, 2022

Rates have gone up six consecutive times, yet very few savers are benefiting, researchers find Millions of people are being short-changed on savings rates, with banks and building societies failing to pass on this month’s 0.5 percentage point interest rate rise, research has claimed. Continue reading.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

William Mills

AUGUST 16, 2022

If you’re not one of the millions around the world who has been sucked into the “Stranger Things” phenomenon, the title reference may not make much sense to you. In short, the town of Hawkins, Indiana has fallen victim to Vecna, a humanoid monster with movable vines that protrude from his entire body and uses mental connections to control and attack teenagers of the town.

The Paypers

AUGUST 16, 2022

The Reserve Bank of India (RBI) has released, on 10 August 2022, its regulatory framework for digital lending, following recommendations put forward by the digital lending working group in November 2021.

BankInovation

AUGUST 16, 2022

Fresh from their shake-up of Gen Z’s shopping habits, buy-now-pay-later firms are now targeting business payments as the next sector ripe for disruption. Startups such as Billie, Mondu, Tranch and Tillit are all offering BNPL solutions -- which allow buyers to split their payments into instalments -- to companies in an attempt to secure a […].

The Paypers

AUGUST 16, 2022

The European Union (EU) has announced plans to create a sixth Anti-Money Laundering Authority that will be specifically tasked with regulating the cryptocurrency industry.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

AUGUST 16, 2022

Lauren McCollom, director of banking-as-a-service (BaaS) at Grasshopper Bank, will join the speaker faculty of Bank Automation Summit Fall 2022 to discuss “Embedded Finance: Frontiers in Open Banking” on Monday, Sept. 19, at 1:45 p.m. PT. Bank Automation Summit Fall 2022 will take place live at the Hyatt Olive 8 in Seattle on Sept. 19-20. […].

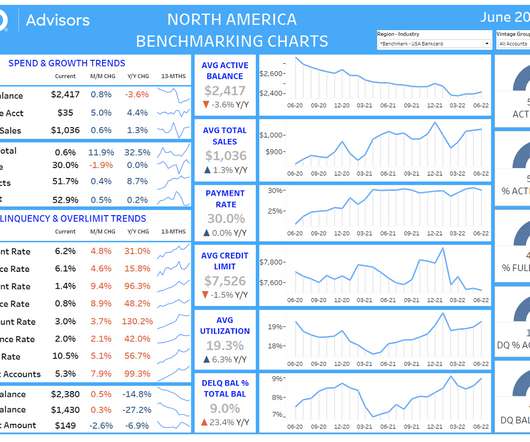

FICO

AUGUST 16, 2022

Home. Blog. FICO. US Bankcard Industry Benchmarking Trends: 2022 Q2 Update. Bankcard delinquencies continue to rise as growth in the economy slows. Saxon Shirley. Wed, 05/25/2022 - 03:43. by Leanne Marshall. expand_less Back To Top. Tue, 08/16/2022 - 15:30. FICO Community releases quarterly US Bankcard Industry Benchmarking trends. To catch up on the last quarter click here.

BankInovation

AUGUST 16, 2022

America’s Credit Union is moving away from passwords toward biometric solutions and extending its partnership with fintech company Access Softek to its back-office security protocols in order to increase fraud-detection capabilities. The DuPont, Wash.- based bank had previously integrated Access Softek’s biometric offering into its call center operations, and the security upgrades are planned to […].

FICO

AUGUST 16, 2022

Home. Blog. FICO. Canada Bankcard Industry Benchmarking Trends: Q2 2022 Update. Bank of Canada makes major rate hike and consumer inflation increases; low unemployment rate continues. Saxon Shirley. Thu, 05/12/2022 - 07:46. by Amir Sikander. expand_less Back To Top. Tue, 08/16/2022 - 15:30. The FICO Blog releases quarterly Canadian Bankcard Industry Benchmarking trends.

Advertisement

Commercial lending is on the verge of a resurgence, but traditional processes are an obstacle. Explore the top 3 reasons for resistance to digital transformation and how overcoming them can pave the way for growth and efficiency. Discover why embracing automation and digital solutions is crucial for success in today's competitive landscape. Discover how GoDocs helps commercial lenders in the digital era with seamless integration and a borrower-focused approach.

The Paypers

AUGUST 16, 2022

Netherlands-based bank ABN Amro has launched Groepie, a feature for its app Tikkie, that allows users to track and settle costs as a group.

The Banker

AUGUST 16, 2022

Open banking offers opportunities for data-driven business models by allowing customers to share their banking data securely with third parties. The next step is unlocking customer data across the financial sector. Comment by Paul Anning, Karima Lachgar and Seirian Thomas of Osborne Clarke.

The Paypers

AUGUST 16, 2022

Digital payment solutions provider in the MENA region, Arab Financial Services (AFS) , has announced the launching of its proprietary new digital wallet and payments super app offering, BPay.

American Banker

AUGUST 16, 2022

Advertisement

Technology is rapidly changing the way accountants perform and manage month-end activities. Spreadsheets, email, and shared drives no longer have to slow us down. Join us as we present a "sneak peek" recorded demo of SkyStem's month-end close solution – ART. In under four weeks, your team can start reaping the benefits of month-end close automation by vastly reducing spreadsheets, cut down on reconciliation work, speed up the month-end close, and better manage your remote team.

The Paypers

AUGUST 16, 2022

US-based mobile virtual network operator (MVNO) Telispire has integrated Splitit’s payment method, allowing its mobile virtual network operators to offer instalment payments.

American Banker

AUGUST 16, 2022

The Paypers

AUGUST 16, 2022

European cryptocurrency app Nebeus has announced a partnership with embedded payments platform Modulr to augment its offering with accounts, real-time payments, and Visa cards.

Advertisement

Get ready for the wave of $1.2 trillion in commercial debt maturing in the next 24 months with GoDocs' ModDocs® platform. Traditional loan modifications are slow, expensive, and prone to errors, which put lenders at risk. But with ModDocs®, you can enjoy an innovative solution that eliminates attorney fees, allows on-the-fly loan modifications, and ensures compliance.

The Paypers

AUGUST 16, 2022

China-based ecommerce SaaS platform Dianxiaomi has announced it raised USD 110 million in a Series D funding round led by SoftBank Vision Fund 2 and Sequoia China , with the participation of Tiger Global Management , GGV Capital, and others.

The Paypers

AUGUST 16, 2022

DeFi services platform EQIFi has integrated its EQX token with Shopping.io to allow customers to purchase goods from online retailers through the former’s token.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Let's personalize your content