Innovative: The Business Value of Experience Design (Part 5 of 8)

Perficient

MARCH 17, 2021

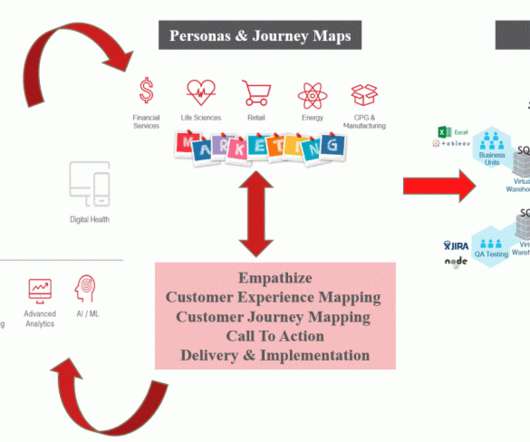

This is the fifth in a series of blog posts sharing the results of our study on the business value of experience design. In this post, we explore the value of innovation: Bringing diverse and fresh ideas and perspectives to help the organization think differently, differentiate and future-proof its investments.

Let's personalize your content