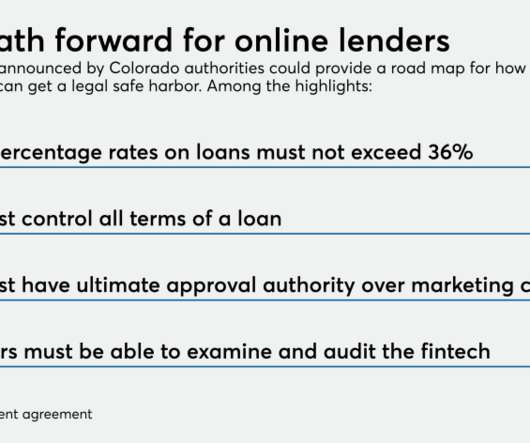

Colorado Settlement Opens Door For Fintech Lenders

Banking Exchange

AUGUST 24, 2020

Colorado may soon witness an influx of new fintech lenders following the conclusion of a long-running legal case Compliance Technology Fair Lending Feature3 Fintech Feature Mobile Online Tech Management Compliance Management Compliance/Regulatory.

Let's personalize your content