Credit card demand remains robust, rejections rise: New York Fed

Payments Dive

NOVEMBER 21, 2023

As consumers have leaned on credit cards more in recent months, applications for credit card limit extensions also rose, the New York Fed said Monday.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Payments Dive

NOVEMBER 21, 2023

As consumers have leaned on credit cards more in recent months, applications for credit card limit extensions also rose, the New York Fed said Monday.

Payments Dive

NOVEMBER 8, 2023

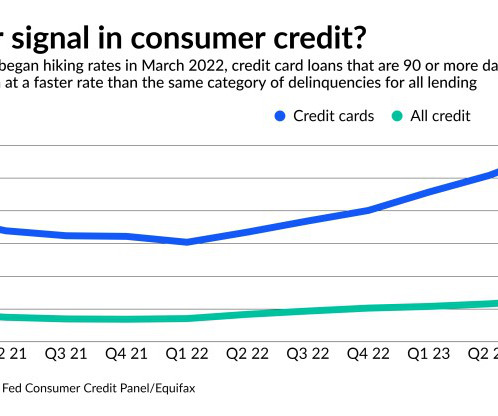

in Q3 2019, according to a report from the Federal Reserve Bank of New York. Nearly 3% of millennials are newly delinquent as of the third quarter this year, slightly up from 2.5%

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 3, 2024

The state’s new law will force merchants to limit credit card surcharges and more clearly disclose them to consumers. If the businesses don’t, they could face a $500 penalty.

Payments Dive

JANUARY 24, 2024

Credit cards balances, auto loans and high rents are straining low-income consumers’ limited budgets, the New York Fed details in a new report.

PYMNTS

JANUARY 9, 2019

New York has banned the ban. In the wake of court filings this week that effectively ended a challenge to surcharges on credit card transactions in New York, merchants in the Empire State can indeed embrace those fees, contingent upon stating those costs to consumers up front. What’s in a name, then?

Payments Dive

MAY 16, 2023

First-quarter credit card balances jumped 17% over the same period last year, according to New York Fed data.

American Banker

NOVEMBER 7, 2023

credit card balances continue to march above $1 trillion, the number of newly delinquent credit card users now exceeds the pre-pandemic average and millennials and those with student or auto loans are driving the increase in past-due payments, the New York Fed said.

CFPB Monitor

DECEMBER 20, 2023

On December 13, 2023, New York Governor Hochul signed two laws, which aim to protect consumers from (1) unwanted subscriptions by requiring notice to consumers for upcoming automatic renewals with clear instructions for canceling, and (2) confusion over prices by requiring merchants to post the highest price a consumer may pay for a product regardless (..)

Payments Dive

AUGUST 9, 2023

Second-quarter credit card balances saw “the most pronounced worsening in performance” compared to other categories such as housing and student loan debt, the New York Fed said.

PYMNTS

JUNE 25, 2020

In today’s top news, Wirecard files for insolvency, and New York proposes easing regulations for cryptocurrency licenses. New York To Ease Cryptocurrency Regulations. Samsung To Roll Out Pay Card For Digital Wallet With Mastercard, Curve. Wirecard Files For Insolvency, Seeks Court Protection.

CFPB Monitor

DECEMBER 6, 2022

Earlier this year, New York delayed the effective date of its new law requiring card issuers to provide a grace period for using credit card rewards points that was slated to be effective later this week. The delay means that the effective date of the new law is now December 10, 2023.

PYMNTS

MAY 18, 2017

In the latest development in New York state’s debate over payroll card regulation, Department of Labor has reportedly appealed an earlier decision that invalidated and revoked earlier regulations on payroll cards issued by the Department. The regulations, it continued, overlapped bank regulations on payroll card fees.

PYMNTS

JUNE 24, 2016

The New York State Department of Labor said earlier this month through a published proposed rule that current consents are invalid for direct deposit and must be reinstated by employees. They must be informed about all their payment options and that they need not accept a payroll debit card.

Payments Dive

NOVEMBER 18, 2022

Debt burdens and delinquencies are rising more rapidly for younger and less wealthy borrowers, the New York Federal Reserve Bank researchers said.

American Banker

FEBRUARY 9, 2024

The city's pilot program enables asylum seekers to pay for food and baby products — reducing government overhead while introducing newcomers to the local economy.

PYMNTS

SEPTEMBER 9, 2016

New York State workers who get paid via prepaid card will have more consumer protections starting next year. According to a report by The New York Times , the new rules, which some consumer advocates said are the strongest in the country, are designed to ensure employees don’t have to pay any fees to access their paychecks.

PYMNTS

NOVEMBER 9, 2016

Quite possibly, the biggest blockchain news this week was that Swedish bank SEB announced that intends to build a blockchain channel between New York and Stockholm to enable customers to make real-time transfers, as soon as next year. But banks aside, credit cards may have no choice but to get into the blockchain game.

PYMNTS

MAY 29, 2019

Apple Pay is coming to New York City thanks to a partnership with the Metropolitan Transportation Authority or MTA. According to TheVerge, the rollout of Apple Pay is part of the MTA’s One Metro New York initiative in which it’s testing new payment methods for fares.

American Banker

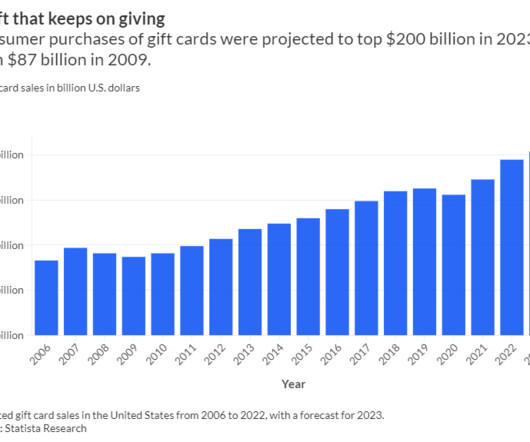

APRIL 16, 2024

Bellwether Community Credit Union's partnership with the New York ad tech firm Prizeout is working to build out gift card programs and generate added sources of non-interest income.

American Banker

MARCH 26, 2024

The potential deal between the major card networks and merchants would see swipe fees reduced and capped for at least three years, pending approval by the U.S. District Court for the Eastern District of New York.

PYMNTS

NOVEMBER 18, 2020

Americans paid off $10 billion in credit card debt in the third quarter (Q3) of 2020, but borrowed more for car and housing loans, according to a report in the Wall Street Journal (WSJ) citing the Federal Reserve Bank of New York. Non-housing balances — credit cards, auto loans, student debt — are up $15 billion.

MyBankTracker

MAY 5, 2021

Looking for a new rewards card? Where you live can make a difference in the card you choose. For example, the best credit cards in New York may not be the best credit cards for someone who lives in Florida or Montana. Best Credit Cards in New York. Best Credit Cards in New York.

PYMNTS

SEPTEMBER 7, 2018

To help consumers experience new ways to pay, Visa has announced a new relationship with New York Fashion Week: The Shows. Through the on-site experience, consumers will be able to tap to pay with contactless cards and devices, the company said in an announcement. “We

Payments Dive

JANUARY 30, 2023

The virtual card company said it would pay $275 million to buy the New York fintech that allows companies to manage their credit card programs.

PYMNTS

OCTOBER 20, 2016

Online lending may be dominated by startup companies based outside of New York, but the New York State Department of Financial Services (NYDFS) wants New York banks to get into the business as well. The products could help serve lower-income people who live in New York and don’t have access to banking.

PYMNTS

JULY 2, 2020

With the pandemic nudging businesses further into the digital payments realm, commercial card innovation is heating up to capitalize on the opportunity for adoption. Boost Bolsters BMO Harris Bank’s Biz Cards. Global Cash Card’s Legal Saga Ends. ADP Eyes Payroll Card Adoption Jump.

Bank Innovation

SEPTEMBER 8, 2017

EXCLUSIVE – With its first credit card out today, New York fintech Petal aims to serve the “credit invisible,” according to its CEO and co-founder Jason Gross, by granting credit cards sans credit score. Instead of focusing on credit scores, Petal looks at an applicant’s financial behavior.

PYMNTS

APRIL 18, 2017

Tipping a taxi driver is a common occurrence in New York City. As such, the Taxi and Limousine Commission put forth a proposal this week requesting car services to only accept credit cards if there’s a tip option available. When ridesharing apps came along, some offered an in-app tip option, while others did not.

PYMNTS

SEPTEMBER 6, 2019

Expanding its footprint in fashion, Visa has announced its renewed sponsorship of New York Fashion Week: The Shows (NYFW) as its official payment technology partner. Shoppers will be able to tap to pay with their Visa contactless cards or digital wallets at Poynt payment terminals, featuring Visa’s sensory branding suite. .

PYMNTS

JULY 22, 2020

has introduced a sustainable credit card to consumers in more than a dozen countries made from recyclable, bio-sourced, chlorine-free, degradable and ocean plastics. The New York-based, multinational financial services (FI) company said six billion cards are produced annually from PVC. Mastercard Inc.

Bank Innovation

SEPTEMBER 7, 2016

Artificial intelligence is set to challenge traditional technologies in financial services, if the startups that demoed at BBVA Open Talent in New York today are any indication. The BBVA Open Talent Challenge is part of Next Money NYC. Today’s event is one of three regional finals, from which a few Read More.

American Banker

OCTOBER 20, 2023

The New York State Department of Financial Services and the Federal Reserve Board penalized Metropolitan Commercial Bank for failing to prevent $300 million in fraud in a prepaid card program. It is the latest example of a bank being sanctioned in connection with rampant fraud during the COVID-19 pandemic.

PYMNTS

NOVEMBER 2, 2017

New York City commuters – arguably the most on-the-go demographic in the United States – do not want to wait for anything. ” It’s an inefficiency that the New York Metropolitan Transportation Authority (MTA) has not only acknowledged, but committed to doing something about. Building A Better Future For Transport.

PYMNTS

AUGUST 9, 2018

Grasshopper, a new bank challenger in New York, is gearing up to go after the banking industry, reported FinTech Futures. According to the report, the bank formerly went by the name New York Ventures Bank and is in the process of getting a banking license. this summer.

PYMNTS

JUNE 17, 2019

To address a major pain point for the LGBTQIA+ community, Mastercard is introducing the True Name card. The product will allow for chosen names to appear on the front of the card, according to news from Mastercard. The company said that his discrimination has carried through to their payment mechanisms and cards until now.

PYMNTS

DECEMBER 16, 2020

Digital sports entertainment and gaming industry platform DraftKings — known for its top-rated daily fantasy sports and mobile sports betting apps — today announced an agreement with InComm Payments , a global leading payments technology company, to launch an industry-first retail gift card. . DraftKings reported on Friday (Nov.

Payments Source

JANUARY 9, 2019

The number of states not allowing surcharging on credit card purchases continues to dwindle, as New York now gives merchants the option to charge fees as long as they make the costs clear to consumers.

Payments Source

MARCH 29, 2017

Supreme Court ordered closer scrutiny of a New York law that bars merchants from imposing surcharges on credit card purchases, giving a group of retailers a partial victory by saying the measure might violate their free-speech rights.

PYMNTS

FEBRUARY 22, 2019

In a settlement that has been given preliminary approval by a federal court in New York, Visa and Mastercard, along with bank defendants, have agreed to provide roughly $6.24 District Court for the Eastern District of New York. billion in settlement funds. According to the notice, which was released on Friday (Feb.

PYMNTS

JANUARY 31, 2021

City National Bank has enlisted New York City FinTech Extend to enable the bank’s clients to offer virtual corporate cards to employees, vendors and other business partners, the companies announced in a press release. Replacing them is much easier than replacing plastic cards. to launch this competitive solution.”.

PYMNTS

JANUARY 28, 2019

Will the ban on the credit card surcharge automatically lead to significantly higher prices when consumers opt for the plastic (via card or digital wallets) at the pump, at the counter … or pretty much anywhere? In New York this month, credit card surcharges got the okay. Maybe, maybe not.

PYMNTS

NOVEMBER 23, 2018

To counter fraud as the holiday season approaches, Best Buy , Target and Walmart made changes to their gift card programs. The moves were announced by the attorneys general of Pennsylvania and New York, Reuters reported. They also come amid an initiative to take on fraudsters that has run for a year. “By

PYMNTS

JANUARY 8, 2020

A New York man, 39-year-old Bogdan Rusu, was sentenced to 60 months in prison on charges of using credit card skimming tactics to steal $390,141 from various New Jersey banks, according to a Department of Justice (DOJ) report. From there, they used the information to steal customers’ money from their accounts.

American Banker

MARCH 24, 2020

It also requires banks and credit unions to provide relief on ATM fees and credit card late payment fees. The regulation issued late on Tuesday directs state-regulated financial institutions to give mortgage borrowers at least 90 days of forbearance if they can show financial hardship resulting from the coronavirus pandemic.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content