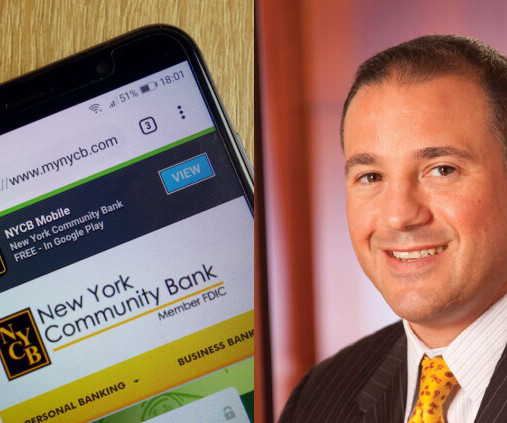

New York Community: Growing pains, strategy miss, or both?

American Banker

FEBRUARY 1, 2024

A day after the regional bank's stock tumbled on tough fourth-quarter results and some austerity moves, observers debated whether management just needs time to build enough capital to catch up with growth or if it is still too overexposed in multifamily lending.

Let's personalize your content