[Webinar Recording] What Financial Institutions Can Learn From Top Brands in Other Industries

Perficient

DECEMBER 29, 2020

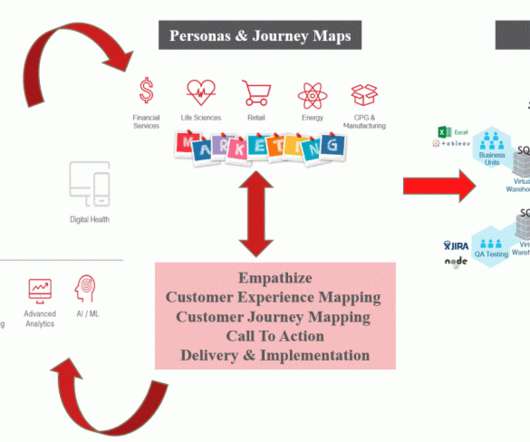

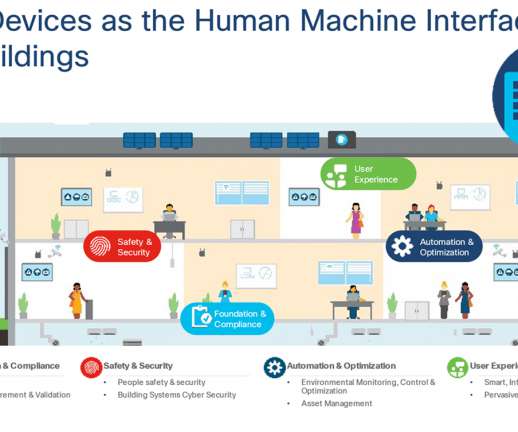

Financial institutions that want to remain ahead of their competition must adopt new business processes and implement fresh digital strategies and technologies. By optimizing these digital efforts, companies will increase sales and provide value to their customers. How will your company take the next step in customer engagement?

Let's personalize your content