Why Legacy Banks Have Mobile App Advantages

PYMNTS

OCTOBER 30, 2018

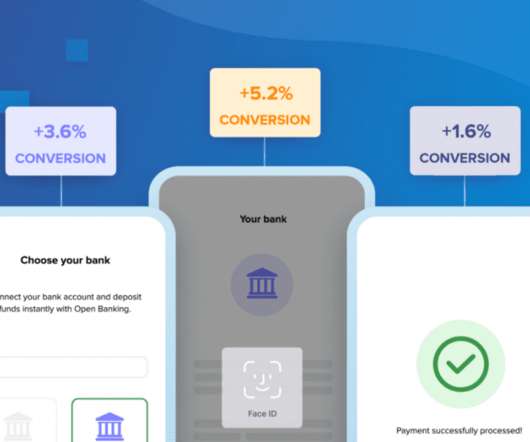

A consumer’s sense of security and trust can be a funny, even unpredictable thing, especially when it comes to payments, banking and commerce. Good UX vs. Security. That said, Oosthuizen noted, those younger developments often tend to focus on “good UX and the consumer experience — in terms of what works. Trust Advantage.

Let's personalize your content