6 payments trends to watch in 2023

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

Payments Dive

JANUARY 10, 2023

FedNow, embedded payments, deal-making, cybersecurity and more mature BNPL will be dominant themes, among others, in the industry this year.

South State Correspondent

JANUARY 23, 2023

No doubt you have heard other bankers talking about ChatGPT. This AI-powered digital assistant, technically called “generative AI,” has taken banking, and society, by storm. In three months, it has become the primary tool of many bankers, helping make banks more efficient across the organization. Our innovation working group, called Spark, has been playing with the tool for the past several months, and this article details how we use it to jump our productivity by 20%.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Payments Dive

JANUARY 26, 2023

At the card giant’s annual meeting Tuesday, CEO Al Kelly showed no signs of backing off crypto. He also suggested Visa’s management team may change after he exits as CEO.

Perficient

JANUARY 25, 2023

2023 has commenced, and rates are climbing, inflation is bubbling, and banking customers are continuing to demand hyper-personalized products and experiences from their institutions. Here are five banking trends we’re forecasting for the new year. 1. Banks are focused on efficiency initiatives to optimize their operations and lower costs. Three prominent areas where there is a strong desire to optimize: Data.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Independent Banker

JANUARY 31, 2023

Photo by Chris Williams [ICBA LIVE is] an opportunity to continue training up the next generation, so I would encourage community bank leaders to join us and bring your rising community continuators with you. The passion I have for community banking was born at ICBA LIVE 2011, which was my first ICBA convention as an adult. I thought I already loved community banking, but I didn’t realize how much until then.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

SWBC's LenderHub

JANUARY 26, 2023

As we discussed in Part 1 of Modernizing the Property Valuation Process , the housing market has experienced dramatic changes that have presented many challenges for appraisers. Although the market has shifted, the challenges remain. While initiatives put in place by Practical Applications of Real Estate Appraisal (PAREA) and The Appraiser Diversity Initiative to provide alternative pathways for aspiring appraisers to join the industry and decrease the shortage of appraisers represent a good sta

Banking Exchange

JANUARY 23, 2023

In separate initiatives, the ABA and CFPB are seeking to add to consumer protection measures related to mortgage lending Mortgage Credit Feature Mortgage Mortgage Compliance Mortgage/CRE Feature3 Compliance/Regulatory Duties

Payments Dive

JANUARY 13, 2023

The buy now, pay later provider said it encountered a “technical issue” and that transactions would be corrected at banks within three to seven days.

Perficient

JANUARY 24, 2023

In the first blog in this series, Getting Started On Embedded Finance , we defined embedded finance and took a high-level look at the goals and strategy a firm should take at the outset of its modern embedded finance journey. In this blog, we will look at how a non-banking company can offer bank-like perks to its clients and workers. When a non-financial firm offers embedded banking, they offer a branded checking account to hold funds and make payments for the betterment of the company and it

Advertisement

Now is the time for lenders to prioritize their digital transformation initiatives in preparation for the lending rebound. Rising competition and ever-increasing customer demands for speed and efficiency are forcing financial institutions to embrace digital transformation. This shift can feel overwhelming—where do you begin? This infographic illustrates automation demands and shows you how loan document automation serves as an essential step to increase profits and provide the best lending exper

Independent Banker

JANUARY 31, 2023

Inspired by the entrepreneurship of lemonade stands, Scottsdale Community Bank created a microloan program. Photo by Brandon Sullivan De novo Scottsdale Community Bank set out to provide microloans to small and mid-size businesses, family organizations and nonprofits—a project that was inspired by the humble lemonade stand. By William Atkinson Name: Scottsdale Community Bank Assets: $28 million Location: Scottsdale, Ariz.

CFPB Monitor

JANUARY 17, 2023

The U.S. Department of Housing and Urban Development (HUD) recently issued a draft Mortgagee Letter on reconsideration of value (ROV) policies in connection with appraisals for FHA insured mortgage loans. The draft Mortgagee Letter follows up on action plan items.

Jeff For Banks

JANUARY 26, 2023

I recently spoke to a community group, and subsequently a community bank all-staff meeting regarding the definition of a community bank. The FDIC has defined community banks in their December 2020 Community Banking Report that either exclude or include the following criteria: Seems complicated. Especially when a community bank could have no office with more than $8.24B in total deposits but could have no more than $1.65B in total assets.

TheGuardian

JANUARY 24, 2023

Stephen Fry, Emma Thompson and Mark Rylance add their voices to Richard Curtis’s Make My Money Matter campaign A raft of famous names including Stephen Fry, Emma Thompson and Mark Rylance have joined activists and businesses in calling on the UK’s big five banks to stop financing new oil, gas and coal expansion. Make My Money Matter , a campaign set up by Richard Curtis , the screenwriter, director and Comic Relief co-founder, has written to the chief executives of HSBC, Barclays, Santander, Nat

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

Payments Dive

JANUARY 31, 2023

The digital payments pioneer said it’s cutting 2,000 employees as the company seeks to adapt to a new, more competitive environment.

ATM Marketplace

JANUARY 13, 2023

Cryptocurrency has taken a big hit of late with the bankruptcy of the FTX crypto exchange, but one crypto entrepreneur that has brought crypto to the vending space believes the technology has a promising future: particularly the oft maligned NFT.

BankUnderground

JANUARY 12, 2023

Kristina Bluwstein, Sudipto Karmakar and David Aikman. Introduction. Inflation reached almost 9% in July 2022, its highest reading since the early 1990s. A large proportion of the working age population will never have experienced such price increases, or the prospect of higher interest rates to bring inflation back under control. In recent years, many commentators have been concerned about risks to financial stability from the prolonged period of low rates, including the possibility of financia

CFPB Monitor

JANUARY 19, 2023

The eyes of the consumer finance world are now on the Supreme Court as it decides whether to grant the CFPB’s certiorari petition in Consumer Financial Services Association Ltd. v. CFPB. In the decision, a Fifth Circuit panel held the CFPB’s funding mechanism violates the Appropriations Clause of the U.S.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

JANUARY 30, 2023

Credit unions and community banks are looking to digital communications platform Eltropy to strengthen call center authentication and ultimately reduce fraud as voice-cloning tools and advanced AI present more opportunities for fraudsters within financial services.

TheGuardian

JANUARY 30, 2023

Exclusive: Leak shows oligarch was a major client of Barclays in Monaco and UBS in Zurich, with at least $940m in assets held at the banks Barclays and UBS are facing questions about their ties to Roman Abramovich after his secretive offshore trusts were reorganised shortly before Europe and the UK imposed sanctions on the Russian oligarch. The Oligarch Files, a cache of leaked documents seen by the Guardian, suggest that before Russia invaded Ukraine the two banks held at least $940m (£760m) of

Payments Dive

JANUARY 12, 2023

The acquisition is the latest B2B move for the card company, which expects Nipendo’s capabilities to strengthen its position in that market.

ATM Marketplace

JANUARY 17, 2023

Going into 2023, ATMs are at a crossroads both in terms of overall banking strategy and payments trends.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

ABA Community Banking

JANUARY 11, 2023

Meet Saleem Iqbal, ABA’s Community Bankers Council chair. The post ‘My hobby is banking’ appeared first on ABA Banking Journal.

CFPB Monitor

JANUARY 26, 2023

The CFPB recently hosted the first hearing of the Appraisal Subcommittee of the Federal Financial Institutions Examination Council (“ASC”) on appraisal bias. The hearing was led by CFPB Deputy Director Zixta Martinez and ASC Executive Director Jim Park. HUD Secretary Marcia L. Fudge, CFPB Director Rohit Chopra, and FHFA Director Sandra Thompson also participated in the hearing.

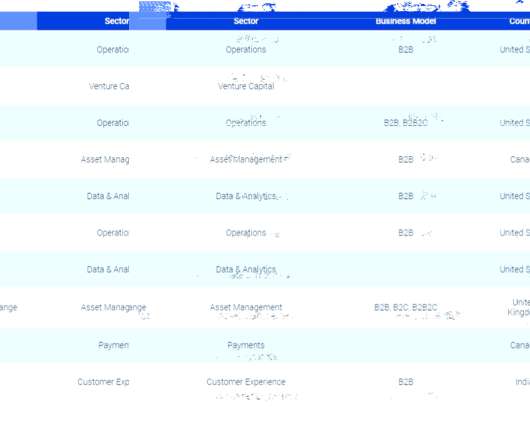

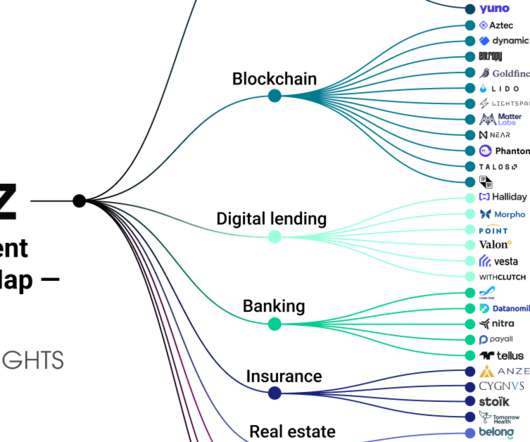

CB Insights

JANUARY 26, 2023

The fintech industry took a hard hit in 2022 as investors scaled back their investments amid market turmoil. However, some top investors like Andreessen Horowitz (a16z) remained active in the space across various deal stages, valuations, geographies, and sub-industries. Fintech is central to a16z’s investment strategy. In recent years, the firm has not only shored up its presence in more familiar sectors like banking, but also reached deeper into newer territory like blockchain.

TheGuardian

JANUARY 19, 2023

Data shows UK banks losing well-paid staff, as Italy, France and Spain make up 70% of rise in EU top earners A record 1,957 bankers across Europe earned more than €1m (£878,000) last year, according to data that shows the scale at which some of the best-paid jobs in Britain have moved from London to the EU since Brexit. The European Banking Authority disclosed on Thursday that the number of bankers earning €1m or more a year had increased by more than 40%, from 1,383 in 2020 to 1,957 in 2021.

Advertiser: Trellis

Trellis is a state trial court research and analytics platform that provides Real Estate Professionals (Buyers, Foreclosure, Loan Modification, etc.) with LEADS on Pre-Foreclosures, Lis Pendes, Distressed Assets and more — to help uncover **new** opportunities and grow their business. The process is quick and easy — and all in real time. Trellis will supply you with a link to the relevant dockets, a Leads sheet and access to its UI where applicable.

Let's personalize your content