Market Commentary: Week of August 2, 2021

SWBC's LenderHub

AUGUST 2, 2021

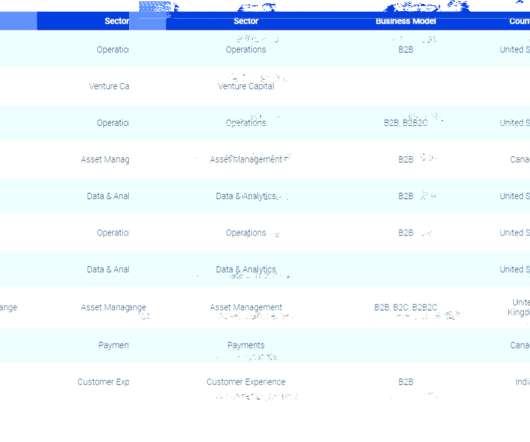

Last Week. The highlight of the week was the July FOMC meeting and announcement. Importantly, there was some language change that acknowledged the continued progress made by the economy and that they are now actively looking at the data to decide when to begin tapering.

Let's personalize your content