10 Takeaways From Our “Transforming Debt Collections and Recovery Functions” Podcast

Perficient

MARCH 25, 2021

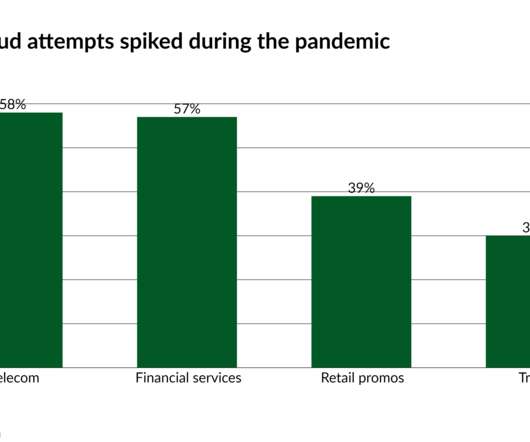

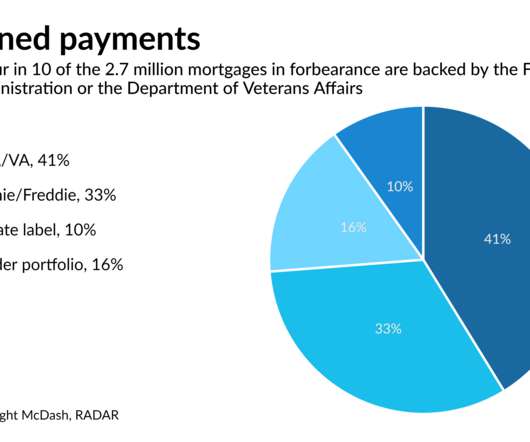

Scott Albahary, Perficient’s financial services chief strategist, and I recently spoke with the Western Bankers Association about using empathy and personalization strategies to improve debt collection and recoveries. If you get a chance, listen to the short episode. But, if you can’t, here are the key points Scott and I make: Banks responded generously to support their customers’ debt hardship needs through the pandemic, but programs are ending.

Let's personalize your content