The Four Pillars of Smarter Bank Leadership

Gonzobanker

NOVEMBER 2, 2023

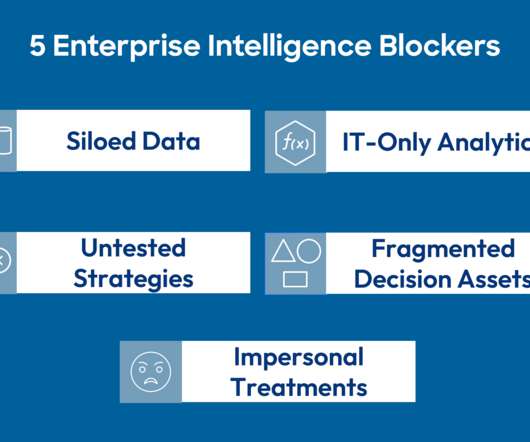

Financial institutions standing in 2030 will have completed a significant and gut-wrenching transformation of their leadership talent. To overcome the struggle, banks need to build leadership teams that align with how a future “Smarter Bank” will operate. How did the team score? Where is there work to do?

Let's personalize your content