Who Owns Digital? Ugh, That’s the Problem for Bankers

Gonzobanker

JULY 20, 2022

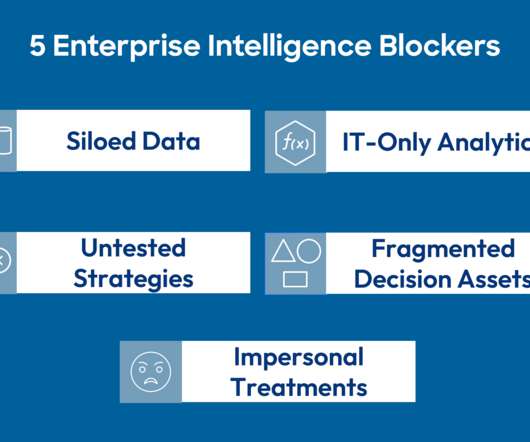

The lack of clear ownership in driving digital transformation represents a huge roadblock for financial institutions fighting to stay relevant. Bank executives are coming to understand that in today’s world, the customer experience (CX) is the product, although not all have made a serious commitment to address newfound competition.

Let's personalize your content