How Perficient and Microsoft Can Help You Return to Work

Perficient

OCTOBER 6, 2020

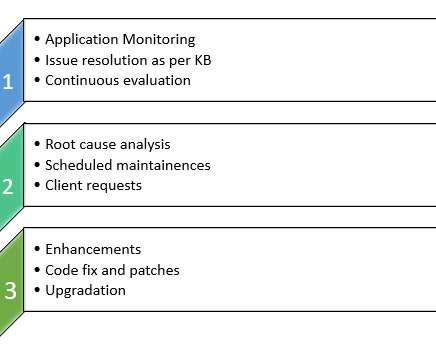

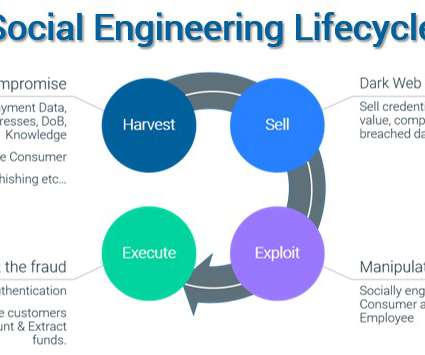

Additionally, we can help you explore process improvements as agile practices expand throughout the organization, help implement agile project management practices, and expand DevOps around continuous integration and continuous deployment. Security and compliance considerations. Ingest and curate knowledge bases.

Let's personalize your content