DevSecOps Best Practices ? Automated Compliance

Perficient

JUNE 5, 2020

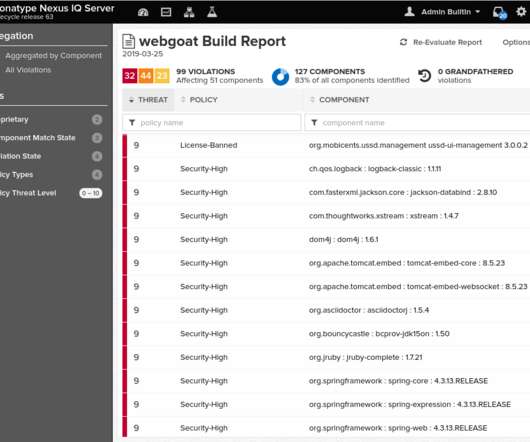

As a best-practice it is recommended to adopt automation of certain security audits, integration of compliance oversight into key development process areas (e.g. Operational Security. Secrets are necessary for the operation of all modern software systems. Intake, Construction, Release Management), and DevOps pipeline tooling.

Let's personalize your content