The Difference Between a Community Bank and a Big Bank

Jeff For Banks

JANUARY 26, 2023

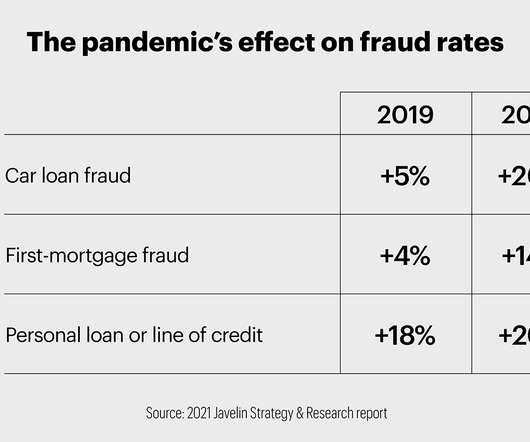

I recently spoke to a community group, and subsequently a community bank all-staff meeting regarding the definition of a community bank. The FDIC has defined community banks in their December 2020 Community Banking Report that either exclude or include the following criteria: Seems complicated.

Let's personalize your content