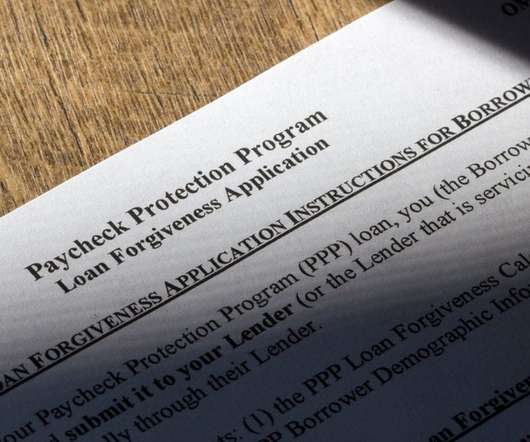

Farm credit trade associations file motion seeking to intervene in Texas lawsuit challenging CFPB small business lending rule

CFPB Monitor

SEPTEMBER 13, 2023

Last week, three farm credit trade associations filed the latest in a series of unopposed emergency motions for leave to intervene in the Texas case challenging the Consumer Financial Protection Bureau’s (“CFPB”) final small business lending rule implementing Section 1071 of the Dodd-Frank Act (Rule).

Let's personalize your content