Visa preps for US pay-by-bank services

Payments Dive

MAY 28, 2024

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

Payments Dive

MAY 28, 2024

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

Alex Jimenez

MAY 28, 2024

For the past few years I’ve noticed that more and more banking and banking technology articles about the future of banking seem to be informed by dubious claims. The writers derive these claims from customer opinion polls and immediately jump to conclusions without understanding survey methodology. Some researchers and consultants conduct customer opinion surveys with biased questions and limited responses.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

BankInovation

MAY 23, 2024

TD Bank is exploring the use of generative AI within its institution through pilot programs. “Understanding how generative AI can be used to augment the work of our colleagues has always been our focus,” Imran Khan, head of TD Invent, the bank’s innovation arm, told Bank Automation News.

Gonzobanker

MAY 23, 2024

It’s “leave your emotions at the door” time when making a core system decision. Esteemed Gonzo readers, let’s get right to one of the core challenges in banking. Every financial institution needs to get real, tangible returns on every technology investment it makes, and core systems are a critical piece in increasing or hurting these returns.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Jack Henry

MAY 24, 2024

What’s more extensible than a product that allows you to solve a variety of use cases by combining components to suit your needs? Click to learn more.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

ABA Community Banking

MAY 23, 2024

Roughly 30% of military families cite low income and lack of stability as a “primary challenge” they face with their current financial products and services, according to a new survey by the Fort Leavenworth, Kansas-based Armed Forces Bank. The post Bank survey: Military families cite low income, inflation as financial product challenges appeared first on ABA Banking Journal.

ATM Marketplace

MAY 28, 2024

At a time when a seamless customer journey is more important than ever, vertical integration allows organizations to prioritize customization, increase connectivity and develop software and hardware systems that keep customers happy and engaged.

TheGuardian

MAY 26, 2024

First-quarter earnings show £580m pool, reflecting increase in share price as bonus cap scrapped in UK London bankers at Goldman Sachs have seen their pay pot jump by more than 20% so far this year, as the bank’s surging share price added to the prospect of bumper payouts after bonus caps were lifted in the UK. Filings covering Goldman Sachs International’s (GSI) first-quarter earnings show that it built up a $735m (£580m) pay pool in the three months to March, averaging out at about $218,000 (£

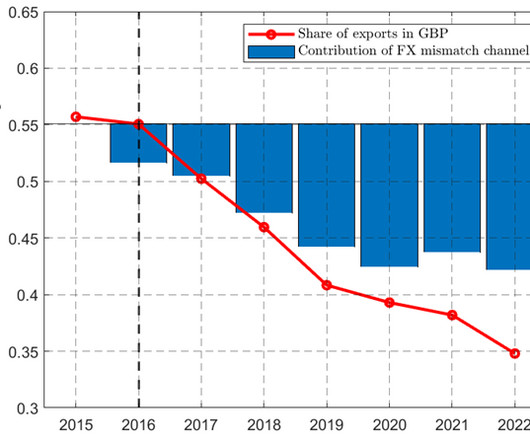

BankUnderground

MAY 23, 2024

Marco Garofalo, Giovanni Rosso and Roger Vicquery Most international trade is denominated in dominant currencies such as the US dollar. What explains the adoption of dominant currency pricing and what are its macroeconomic implications? In a recent paper , we explore a rare instance of transition in aggregate export invoicing patterns. In the aftermath of the depreciation that followed the Brexit referendum in 2016, UK exporters progressively shifted to invoicing most of their exports in dollars

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

Payments Dive

MAY 24, 2024

The retail behemoth and its credit card issuer said in a terse, joint press release Friday that they’re parting ways.

Commercial Lending USA

MAY 28, 2024

You can get commercial property financing with debt service coverage ratio loans or DSCR loan requirements.

American Banker

MAY 28, 2024

Rather than compete against the rising tide of account-to-account transactions, the two card networks are looking for ways to make themselves essential to this growing market.

BankInovation

MAY 29, 2024

Cache Valley Bank has selected fintech Finastra for its core banking and digital banking offerings. The Logan, Utah-based bank will use the tech provider’s core banking platform, Fusion Phoenix, and its mobile banking platform, Fusion Digital Banking, for commercial and retail banking clients, according to a May 16 release from Finastra.

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

ABA Community Banking

MAY 29, 2024

The banking industry reported net income of $64.2 billion in the first quarter of 2024, an increase of $28.4 billion or 79.5% from the previous quarter, according to the FDIC’s most recent Quarterly Banking Profile released today. The figure was down from Q1 2023, when FDIC-insured banks and savings institutions earned $79.8 billion.A 13.3% decline […] The post Quarterly Banking Profile: Banking net income $64.2 billion in Q1 2024 appeared first on ABA Banking Journal.

Payments Dive

MAY 29, 2024

Roughly 72% of consumers say they swipe, dip or tap a debit card at the point of sale, a larger portion than credit cards, checks and digital wallets, according to a consumer survey by research firm J.D. Power.

TheGuardian

MAY 28, 2024

Although fraudsters gave one of its account numbers, it was totally uninterested as I was not its customer I am the treasurer of a small charity, and recently received an email that appeared to come from the chair asking me to send a £780 payment to a supplier. I immediately realised that it was a scam – it wasn’t written in his style, and, when I looked closely, it hadn’t come from his email address.

American Banker

MAY 24, 2024

Analyzed from a property rights perspective, the dividends paid by the Federal Home Loan banks to their members are surprisingly stingy, and vary wildly between the different banks.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

BankInovation

MAY 28, 2024

Scotiabank saw digital adoption among customers and its tech spend tick up during its fiscal second quarter 2024. The Toronto-based bank reported active mobile users increased 10% year over year to 4.3 million, while its digital adoption rate increased 2.7% YoY to 64.5% in Canada in the quarter ended April 30.

The Paypers

MAY 23, 2024

Trading and investment platform eToro has partnered with Arabesque AI to launch a new Sharia-compliant portfolio for users in the Middle East.

Payments Dive

MAY 28, 2024

The new offering by the digital payments pioneer will be led by Mark Grether, who helped grow Uber Advertising into a $1 billion business.

TheGuardian

MAY 24, 2024

Agreement will create lender with almost 5m customers and £89bn balance sheet The Co-operative Bank is to return to its mutual roots after Coventry Building Society confirmed that it will acquire the bank from its hedge fund owners for £780m. The deal has now been finalised after Coventry said it had made a non-binding cash offer for the bank last month that will create a lender with almost 5 million customers and an £89bn balance sheet.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

American Banker

MAY 23, 2024

The bank took a big hit on an office property in Washington, D.C., during the first quarter. This month, it filed a shelf registration statement for an offering of up to $150 million that could be used to bolster capital or refinance debt.

BankInovation

MAY 28, 2024

Lia Cao, global head of embedded finance and solutions at J.P. Morgan Payments, is focused on meeting consumers where they want to be met through integrated banking services. “Consumer demand is driving significant interest in embedded banking and alternative payment methods,” Cao told Bank Automation News. To keep up with demand, J.P.

The Paypers

MAY 27, 2024

BBVA has become the first European bank to form an alliance with OpenAI , aimed at using OpenAI's expertise to enhance the bank's use of generative AI.

Payments Dive

MAY 28, 2024

The big bank-backed digital wallet is now accepted by about 80,000 "primarily small" merchants according to Early Warning Services Managing Director James Anderson.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content