Visa preps for US pay-by-bank services

Payments Dive

MAY 28, 2024

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

Payments Dive

MAY 28, 2024

The card network is focused on “stubborn categories” where large account-to-account payments have taken hold, such as in healthcare, education and rent, a Visa executive said.

Perficient

MAY 30, 2024

Our banking risk and regulatory experts are excited to attend the upcoming XLoD Global event in New York on June 11th. What is XLoD Global? The world’s leading financial institutions and regulators come together at XLoD to discuss the future of non-financial risk and control. Representatives from all three lines of defense—operational management, risk management/compliance, and internal audit—attend to present, discuss, and learn about industry shifts that are impacting risk and regul

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abrigo

MAY 30, 2024

Elder fraud prevention and education Learn strategies for recognizing and reporting elder fraud and exploitation. Would you like other articles on BSA/AML training in your inbox? Takeaway 1 Elder abuse, exploitation and fraud continue to rise as the baby boomer generation ages. Takeaway 2 Learn to recognize common types of elder abuse and the red flags that may accompany them.

South State Correspondent

MAY 30, 2024

In discussing ERC (Employee Retention Credit) with banks over the last year, we discovered a common theme. Most banks have either been told they are not eligible or come to this conclusion on their own because they did not experience a decrease in revenues. Many banks performed better than expected during the pandemic due to offering paycheck protection program (PPP) loans.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Jeff For Banks

MAY 30, 2024

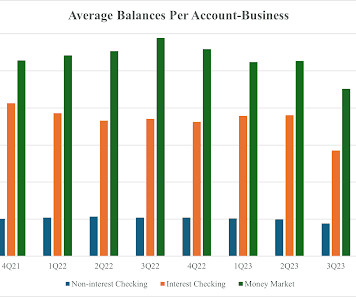

In December 2021, when the Fed Funds Rate stood at 0-25 basis points and prior to the Fed's tightening beginning in the first quarter of 2022, there were $18.2 trillion in domestic deposits, according to the FDIC's Statistics at a Glance. In December 2023, a full three quarters after the Fed paused its tightening of the Fed Funds Rate (QT continued), domestic deposits stood at $17.3 trillion.

Community Banking Brief brings together the best content for Community Banking professionals from the widest variety of industry thought leaders.

American Banker

MAY 30, 2024

Shan Hanes, who led Heartland Tri-State Bank in Kansas until it failed last year, pleaded guilty to one count of embezzlement by a bank officer. He now faces up to 30 years in prison. He is scheduled to be sentenced on Aug. 8.

Jack Henry

MAY 24, 2024

What’s more extensible than a product that allows you to solve a variety of use cases by combining components to suit your needs? Click to learn more.

South State Correspondent

MAY 28, 2024

Most borrowers are implicitly expressing a view that interest rates will be lower in the future than the current market expectation. This view is reflected by a sharp decrease in the average contractual loan commitment term at community banks and an increase in floating vs. fixed rate structures. Borrowers are choosing short-term financing in anticipation of the Federal Reserve embarking on an interest rate-cutting cycle.

Alex Jimenez

MAY 28, 2024

For the past few years I’ve noticed that more and more banking and banking technology articles about the future of banking seem to be informed by dubious claims. The writers derive these claims from customer opinion polls and immediately jump to conclusions without understanding survey methodology. Some researchers and consultants conduct customer opinion surveys with biased questions and limited responses.

Advertisement

Dive into the complexities of New York lien laws with our comprehensive eBook, 'New York Lien Law Essentials: 5 Key Facts for Commercial Lenders.' In this detailed guide, we explore the critical formalities necessary for lenders navigating ground-up construction and fix-and-flip projects in the New York market. From documentation requirements to the implications of non-compliance, learn how to safeguard your lending position and prioritize legal adherence.

Payments Dive

MAY 24, 2024

The retail behemoth and its credit card issuer said in a terse, joint press release Friday that they’re parting ways.

American Banker

MAY 29, 2024

The retail giant has scrapped its credit card partnership with Capital One, its second public spat in recent years with a partner bank. Analysts say it may be a sign that Walmart wants to launch its own credit card on what it hopes will be a financial super-app.

ATM Marketplace

MAY 28, 2024

At a time when a seamless customer journey is more important than ever, vertical integration allows organizations to prioritize customization, increase connectivity and develop software and hardware systems that keep customers happy and engaged.

TheGuardian

MAY 26, 2024

First-quarter earnings show £580m pool, reflecting increase in share price as bonus cap scrapped in UK London bankers at Goldman Sachs have seen their pay pot jump by more than 20% so far this year, as the bank’s surging share price added to the prospect of bumper payouts after bonus caps were lifted in the UK. Filings covering Goldman Sachs International’s (GSI) first-quarter earnings show that it built up a $735m (£580m) pay pool in the three months to March, averaging out at about $218,000 (£

Advertisement

In this report, you’ll find a comprehensive analysis of survey responses from executives at banks, credit unions, and insurance companies concerning their organization’s current and future use of automation. The report’s key insights include: Which types of automation are saving organizations the most time and money How to overcome the biggest barriers to automation implementation and adoption Why automation investments will continue to grow over the next few years How much you could save in 202

BankInovation

MAY 30, 2024

Royal Bank of Canada is on target to fully integrate HSBC Canada into its operations within the next two years. The $1.4 trillion bank expects to save CA$740 million ($541 million) once the merger is completed, according to the bank’s earnings report for its fiscal second quarter ending April 30.

Payments Dive

MAY 29, 2024

Roughly 72% of consumers say they swipe, dip or tap a debit card at the point of sale, a larger portion than credit cards, checks and digital wallets, according to a consumer survey by research firm J.D. Power.

American Banker

MAY 30, 2024

OpenAI is training a new flagship AI model to replace the one behind the wildly popular ChatGPT. It seems like a good time to ask, if financial users could design their own generative AI model from scratch, what they would want?

Commercial Lending USA

MAY 28, 2024

You can get commercial property financing with debt service coverage ratio loans or DSCR loan requirements.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

William Mills

MAY 30, 2024

Fintech companies face a formidable challenge: communication gaps that threaten to undermine their sales performance. These disconnects, often manifesting between departments, teams, and even with customers, can lead to misaligned strategies, missed opportunities, and a weakened competitive edge. Addressing these communication barriers is crucial for fintech firms striving to maintain their market position, enhance customer relations, and drive growth in an industry where precision and clarity a

BankInovation

MAY 29, 2024

BMO continued to deliver on its digital-first agenda during its fiscal second quarter 2024 with AI, data and overall modernization at the forefront of its efforts.

Payments Dive

MAY 30, 2024

“Putting these regulations into practice is challenging, and the success of such regulatory measures largely hinges on enforcement,” writes a Wise executive.

American Banker

MAY 29, 2024

Leaders of financial institutions and industry trade groups are working together to provide impacted communities across the U.S. with basic necessities and quick, online emergency loans.

Advertiser: Data Robot

The buzz around generative AI shows no sign of abating in the foreseeable future. Enterprise interest in the technology is high, and the market is expected to gain momentum as organizations move from prototypes to actual project deployments. Ultimately, the market will demand an extensive ecosystem, and tools will need to streamline data and model utilization and management across multiple environments.

TheGuardian

MAY 29, 2024

The FCA is considering opening a compensation scheme for customers after an influx of complaints When Gary Hill took out a £12,500 loan to pay for a new family vehicle in late 2014, he had no idea that the north London dealership he had travelled to from his home in Bedfordshire could have sway over his monthly payments. But the 45-year-old was in a bind, having started a new job that no longer gave him access to a company car.

ABA Community Banking

MAY 29, 2024

The banking industry reported net income of $64.2 billion in the first quarter of 2024, an increase of $28.4 billion or 79.5% from the previous quarter, according to the FDIC’s most recent Quarterly Banking Profile released today. The figure was down from Q1 2023, when FDIC-insured banks and savings institutions earned $79.8 billion.A 13.3% decline […] The post Quarterly Banking Profile: Banking net income $64.2 billion in Q1 2024 appeared first on ABA Banking Journal.

BankInovation

MAY 30, 2024

Global fintech funding dropped to a four-year low in the first quarter of 2024 but the number of deals ticked up, according to data intelligence company CB Insights. Fintech funding in Q1 fell to $7.3 billion, registering a 54% drop year over year, according to an April 18 report by CB Insights.

Payments Dive

MAY 28, 2024

The new offering by the digital payments pioneer will be led by Mark Grether, who helped grow Uber Advertising into a $1 billion business.

Advertisement

Most people dread the nearing of the month-end close and reconciliation process, and who can blame them? It's typically a tedious, long, stressful process; but it doesn't have to be. Implementing automation into your month-end process can significantly reduce this headache by automating up to 40% of your reconciliation and saving nearly 30% of your time spent.

Let's personalize your content