Derivatives Usage By Community Banks

South State Correspondent

JULY 19, 2023

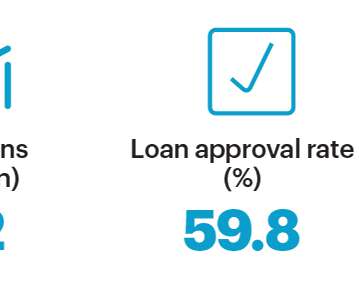

However, the adoption of interest rate swaps is much lower at community banks (banks with under $10B in assets), with only a few hundred banks showing interest rate swap volume. The market expects deposit betas to increase through 2023 and 2024. S&P projected COF and betas are shown in the graph below.

Let's personalize your content