7 Highlights from the Latest FDIC Quarterly Banking Profile

Abrigo

SEPTEMBER 13, 2021

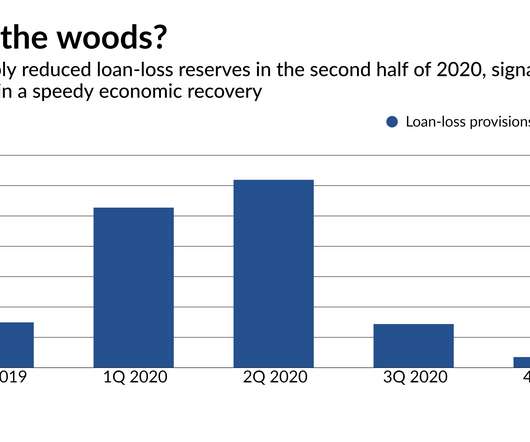

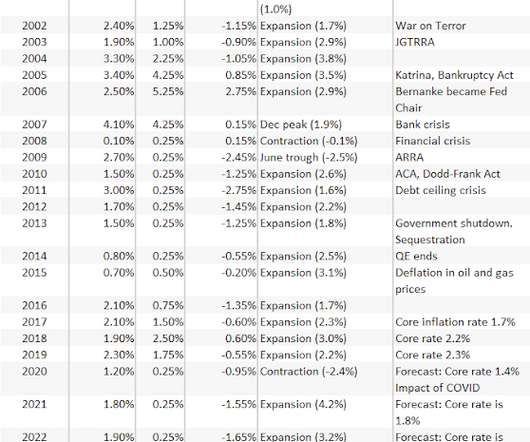

Banking Trends from the FDIC's 2Q Report Net interest margin reached a new record low, but positive signs emerged in lending. You might also like this webinar: "The Basics of Consumer Lending." Summary of the Latest FDIC Quarterly Profile. This represents an increase of 1% over June 2020. Banking Data.

Let's personalize your content