FinTechs Help Banks Ease The PPP Lending Pain

PYMNTS

APRIL 8, 2020

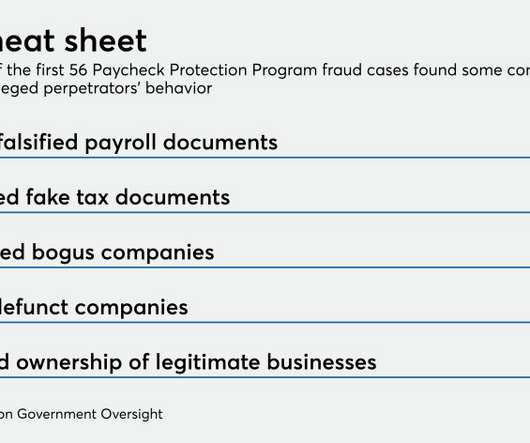

As the nation’s traditional financial institutions struggle to cope, alternative lending platforms and other B2B FinTechs are exploring how to put their own technologies to good use. Small businesses, meanwhile, can use the platform to apply online as fewer physical bank branches are available. Funding Circle. Wolters Kluwer.

Let's personalize your content