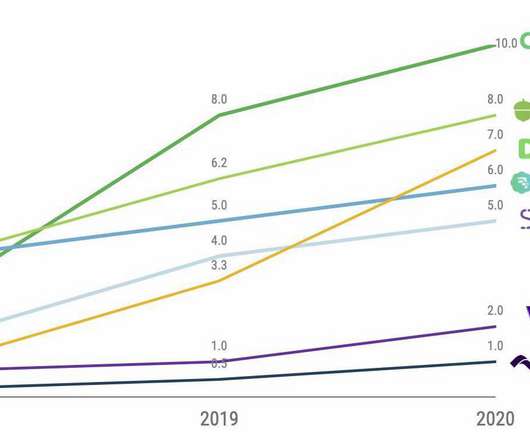

Revolut Adds Crypto To US Offerings With Paxos Deal

PYMNTS

JULY 15, 2020

European FinTech Revolut, which recently debuted in the U.S. With Paxos Crypto Brokerage, companies can leverage our expertise and regulatory compliance to easily and securely integrate crypto into their applications. The Paxos platform offers the security and liquidity we need to offer our users the best crypto experience.”.

Let's personalize your content