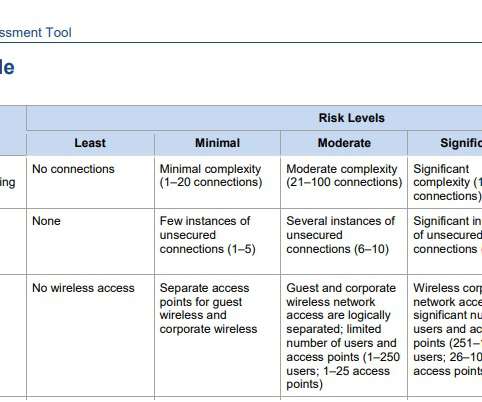

FFIEC Cybersecurity Maturity Assessment Tool

Cisco

AUGUST 9, 2022

As these have attacks have evolved, regulatory bodies have updated their regulations to account for the increasing threat of cyber risk. This was revised in 2017, and this consistent framework is intended to be able to help leadership and the board assess their preparedness and risk over time. External Dependency Management.

Let's personalize your content